![]()

Housing Resource Fair Makes Homebuying Process Accessible to All

After both of her parents passed away, Makiba Woods made the decision to sell the family home that was left to her due to a long list of needed costly repairs. As a mother and longtime renter, Makiba dreamed of having a place for her family to call their own.

But for many years, the down payment and maintenance costs seemed like an overwhelming barrier to homeownership.

“I was a single parent at the time, so most of my resources went toward my daughter’s private school education,” Makiba says. “I didn’t know if I could financially swing owning a home, but I wanted to have a stable place for her to come home to, and that's one thing that renting sometimes doesn’t give you.”

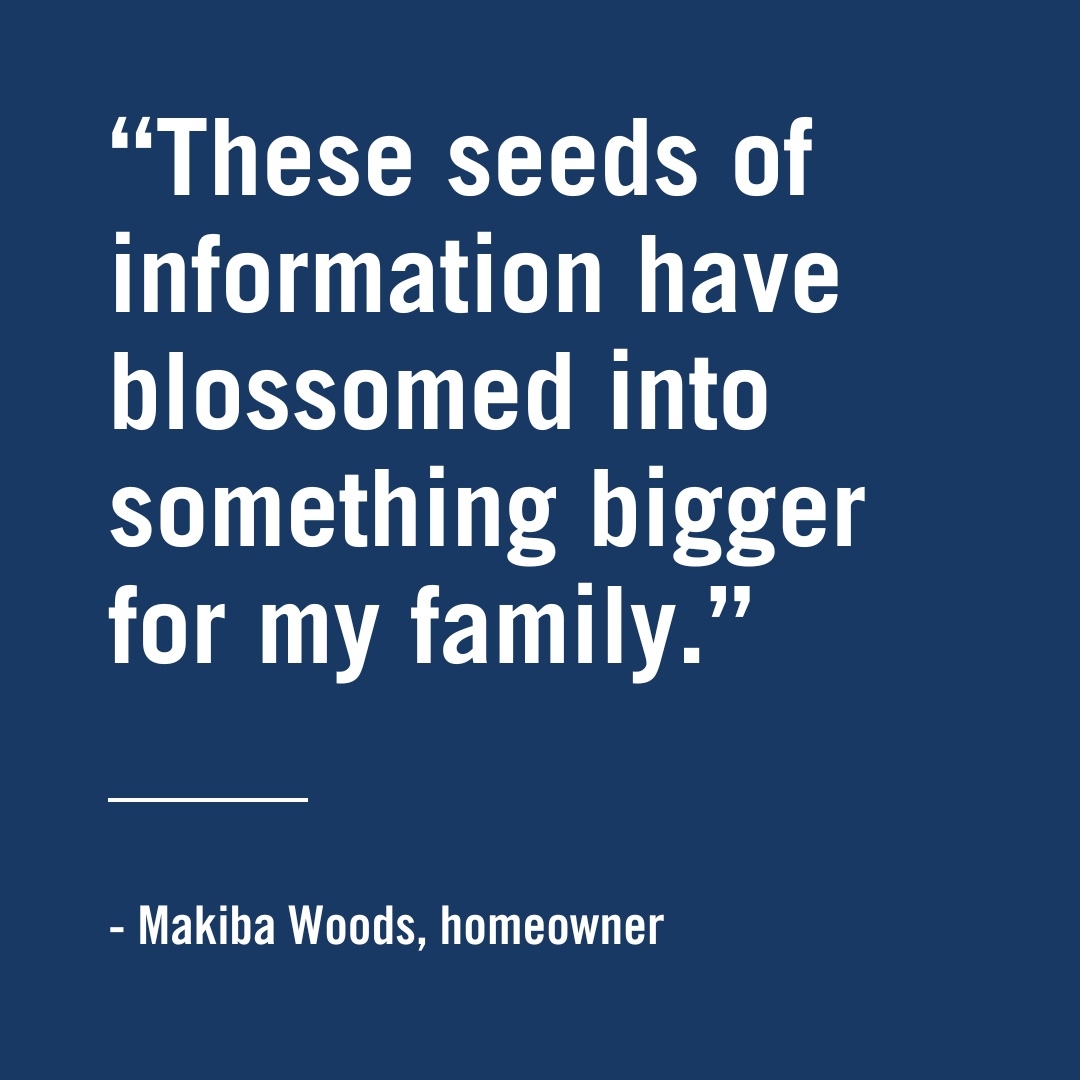

Makiba Woods (left) and Monica Campbell (right) explore vendor booths at the Housing Resource Fair to learn more about the homebuying process.

With a goal of building generational wealth, she decided she would invest the money from her parents’ home into a home of her own. Unsure where to start, Makiba reached out to her longtime friend, Monica Campbell, VP of Community Development at Enterprise Bank & Trust, for guidance.

“I reached out to Monica for advice and she told me about the Housing Resource Fair,” Makiba says. “I went to the fair and did a credit check with an agency to see where I would stand, and, to my surprise, I was in a better place than I thought I was.”

The fair was started to provide opportunities and education to community members living in historically underserved areas throughout St. Louis, Missouri. The vision was to create a one-stop shop for those interested in becoming a homeowner by gathering real estate agents, inspectors, credit specialists and financial advisers from a variety of banks — all under one roof.

“Inviting outside banks shows unity within the banking industry. I wanted people to feel comfortable shopping around and to know that they have options. I wanted to put the power back into the individual,” Monica says.

Makiba was apprehensive in taking the leap, but with the knowledge she gained at the fair and support from her husband, Ralph, she began the process of searching for, finding and eventually purchasing a home.

From taxes to loan approvals, Makiba made sure to educate her daughter every step of the way so she would know what to do when it came time for her to someday buy a home.

“I’m able to give my daughter the education behind homeownership in a way that I wasn’t able to be given," Makiba says. “Although there is a historic lack of resources and lack of homeownership education in my community, these seeds of information have blossomed into something bigger for my family.”

![]()