Award of $50 million Helps Fund Projects in Low-Income, Historically Underserved Areas

The Community Development Financial Institutions (CDFI) Fund of the U.S. Department of Treasury recently selected Enterprise Financial CDE, LLC (EFCDE), the subsidiary of Enterprise Financial Services Corp (NASDAQ: EFSC), to receive a $50 million allocation of New Markets Tax Credits (NMTC). EFCDE received $60 million in 2023, making this the third time the organization has received awards in the last four years.

The CDFI Fund stimulates economic revitalization and community development in low- income communities through programs such as the highly competitive NMTC program, which for more than two decades has worked to attract private sector capital into the most economically distressed and underserved communities across the country. These tax credits provide critical financing for community development projects and qualified businesses located in low-income and underserved communities. “We continue to actively engage with community partners, small businesses and internal stakeholders to learn how access to capital in disinvested communities can improve the quality of life for residents and ensure that EFCDE is driving positive economic change in underserved rural and metro areas across our service area,” EFCDE Executive Director Abby Kepple said. “Additionally, we take seriously the immense responsibility to facilitate meaningful projects and take great pride in having the CDFI reward our work and commitment to the NMTC program.”

This is the seventh overall NMTC allocation awarded to EFCDE and brings the total amount of those allocations to $353 million. To date, those tax credits have subsidized 61 deserving borrowers with high-impact projects that have created and retained more than 10,000 quality jobs and brought essential community services to more than 110,000 underserved residents during a decade of economic change.

This is the seventh overall NMTC allocation awarded to EFCDE and brings the total amount of those allocations to $353 million. To date, those tax credits have subsidized 61 deserving borrowers with high-impact projects that have created and retained more than 10,000 quality jobs and brought essential community services to more than 110,000 underserved residents during a decade of economic change.

Established by Congress in December 2000, the NMTC program helps economically distressed communities attract private investment capital by providing investors with a federal tax credit. Investments made through the NMTC program reverse the disinvestment of underserved low-income communities, with powerful results. According to the CDFI Fund, the NMTC program spurs $8 of private investment for every $1 invested.

More information about EFCDE and the NMTC program can be found here. Enterprise’s annual Community Impact Report, highlighting work in local communities, can be read here.

About Enterprise Financial CDE

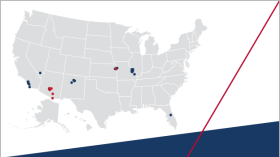

EFCDE operates under a national service area with primary focus across the states of Arizona, California, Illinois, Kansas, Missouri, Nevada, Texas, New Mexico and contiguous states. As a community development entity, EFCDE invests in small businesses that stimulate job creation and economic development across highly distressed communities and community facilities that improve quality of life for underserved populations. EFCDE’s affiliate is a commercial bank, Enterprise Bank & Trust, a growing financial services partner focused on guiding people to a lifetime of financial success. The controlling entity of both subsidiaries, Enterprise Financial Services Corp, representing approximately $14.6 billion in assets, is a financial holding company headquartered in Clayton, Missouri. Additional information is available at www.enterprisebank.com.

About Enterprise Bank & Trust

Enterprise Bank & Trust is a growing financial services partner focused on guiding people to a lifetime of financial success. We empower privately held businesses to succeed, helping families to secure their financial futures, and invest to advance the quality of life for the communities we serve. Enterprise is built on trusted, personal relationships and offers a range of business and personal banking services, wealth management services and a variety of specialized banking services. Enterprise Financial Services Corp (NASDAQ: EFSC), with approximately $14.6 billion in assets, is a financial holding company headquartered in Clayton, Missouri. Named one of Forbes’ America’s Best Banks 2024, Enterprise Bank & Trust operates more than 40 branch offices in Arizona, California, Florida, Kansas, Missouri, Nevada and New Mexico, and SBA loan and deposit production offices throughout the country. Additional information is available at www.enterprisebank.com. Member FDIC.