Market Flash Report November 2024

Economic Highlights

United States

- Based on the second reading, the U.S. economy expanded 2.8% in Q3, down slightly from the 3% growth rate reported in Q2. This was also consistent with the advanced reading. The update primarily reflected upward revisions to private inventory investment and non-residential fixed investment, as well as downward revisions to exports and consumer spending. Imports, which are a subtraction in the calculation of GDP, were revised down. The Atlanta Federal Reserve currently estimates 3.2% growth for Q4.

- U.S. employers added just 12,000 new jobs to the economy in October, well below the 100,000 expectation. Revisions lowered previously reported job creation totals by 112,000 for August and September combined. The Boeing strike and two hurricanes were cited as excuses for the subpar report. Surprisingly, the unemployment rate held steady at 4.1% and average hourly earnings increased 4% Y/Y. Economists project 200,000 new jobs in November with the unemployment rate ticking up to 4.2%.

- The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Index, rose more than expected in October with the annual rate running at 2.3%, up from 2.1% in September. Core PCE was 2.8%, up from 2.7% in the prior month. Services prices generated most of the inflation for the month, rising 0.4% while goods fell 0.1%. Food prices showed little changed, while energy was off 0.1%. Consumer Price Index (CPI), which does not factor in substitutions, has run hotter than PCE inflation. Headline CPI was 2.6% in October and Core was 3.3%.

- Retail sales in the U.S. increased 0.4% M/M in October, following an upwardly revised 0.8% gain in September. Core retail sales actually declined 0.1% last month.

- U.S. manufacturing activity contracted again in November, but at a slower rate compared to October. The ISM Manufacturing Purchasing Managers’ Index (PMI) rose to 48.4 last month from 46.5 in October. New orders rebounded back above 50, but all other major sub-components remained in contraction territory.

Non-U.S. Developed

- The eurozone economy appears to have moved back into contraction territory based on the latest flash PMI data that showed both manufacturing and services fell below the important 50 level. The headline reading fell to a 10-month low at 48.1 while the services component fell to 49.2 in November from 51.6 in October. Manufacturing remained weak with a November PMI reading of 45.2. Results from Germany and France were particularly troubling, although the rest of the eurozone reported increased activity in November. One negative in the report was rising prices, which could impact further European Central Bank (ECB) rate cuts. It is likely the eurozone will continue to face instability, with the main positive being monetary ease of support.

- Eurozone inflation accelerated to 2.3% in November, up from 2% in the prior month. Goods inflation increased slightly, while the stickier services inflation fell modestly. Most of the increase was due to the base effect from lower prints last year. The ECB has quite a dilemma with growth flatlining and inflation remaining above target levels. A 25 bps rate cut in December is still likely.

- The Japanese economy grew 0.2% Q/Q in Q3, down from 0.5% in Q2. Business investment shrank by 0.2% and net trade subtracted 0.4%, as exports rose much less than imports. Private consumption increased 0.9% in Q3, driven primarily by rising wages; government spending also increased 0.5%.

Emerging Markets

- China's factory activity expanded at the fastest pace in five months in November as new orders, including those from abroad, led to a solid rise in production. The Caixin/S&P Global manufacturing PMI rose to 51.5 in November from 50.3 the previous month. New export orders, in particular, rose for the first time in four months and marked the highest in seven months. China’s official manufacturing PMI came in at 50.3 in November, its highest level since April. A concern is the slip in the non-manufacturing PMI which fell to 50.0 last month from 50.2 in October.

- India's economic growth slowed more than expected in the second quarter of the financial year, hampered by weaker expansion in manufacturing and consumption, adding pressure on the central bank to cut rates. The Indian government is taking steps to boost spending, particularly on infrastructure, to achieve its 6.5-7% GDP growth target.

- The threat of tariffs and retaliation by the incoming Trump administration on countries at the forefront of U.S. economic policy have seen their currencies suffer in recent weeks. The threat of tariffs against Mexico and Canada over immigration controls sent both the Canadian dollar and Mexican peso lower, while the trade threats against China have sent the yuan to a 4.5 month low against the USD. A recent statement focused on the BRICs maintaining the USD as the world’s reserve currency put more pressure on the Russian ruble, Brazilian real and Indian rupee.

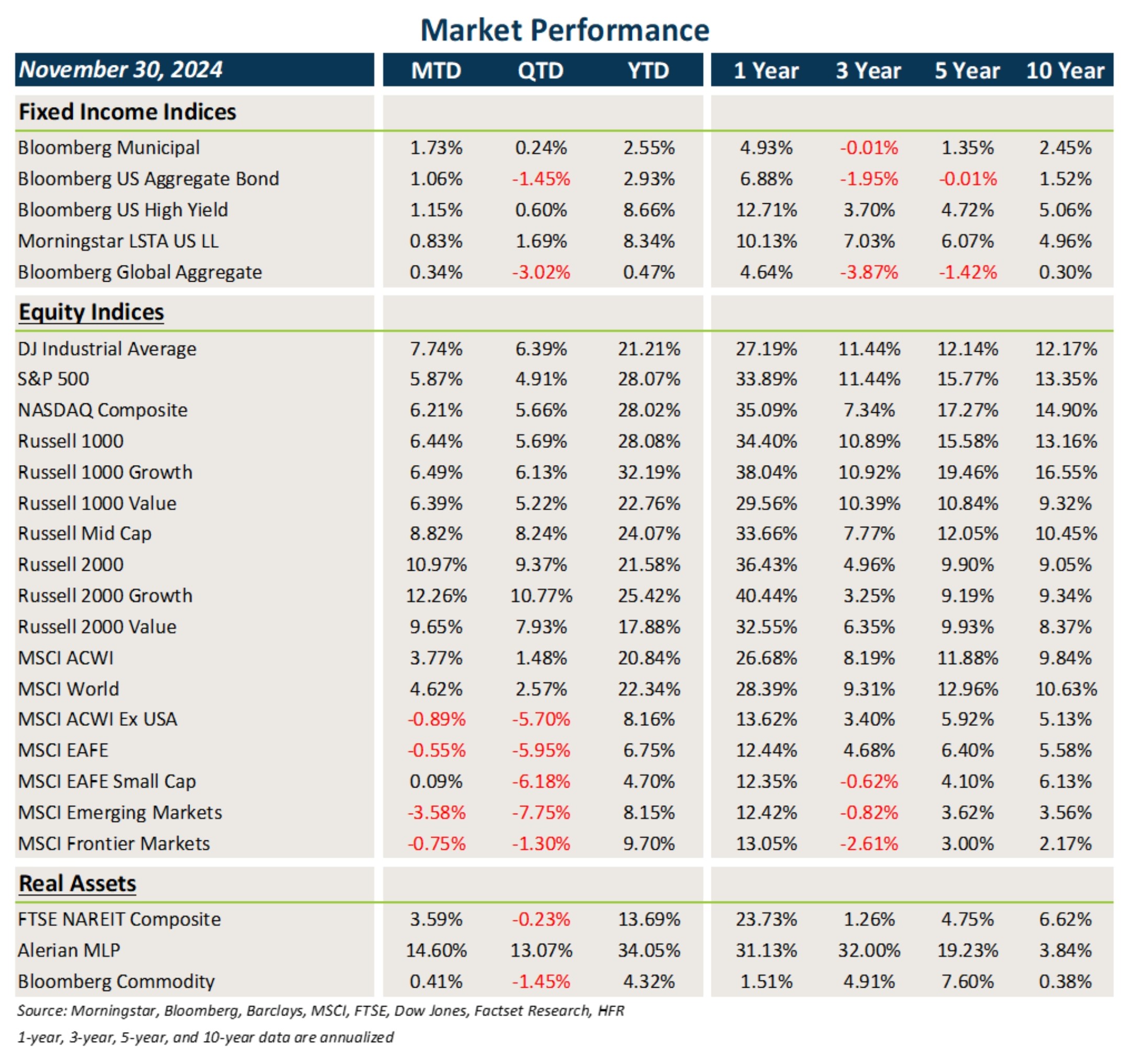

Fixed Income

- After perhaps overshooting on the upside, treasury and other sovereign debt yields fell in November, leading to gains in core fixed income and munis.

- Credit spreads tightened further on the heels of the strong rally in risk assets following the presidential election.

- Bonds outside the U.S. posted positive returns, but were held back by the stronger U.S. dollar.

U.S. Equities

- U.S. equities raced higher in November once Trump was declared the 47th President of the U.S.

- Small caps were the real winners and growth outperformed value across all market caps.

- U.S. equities have led the world once again in 2024, and it is positive seeing the market broaden out over the past few months.

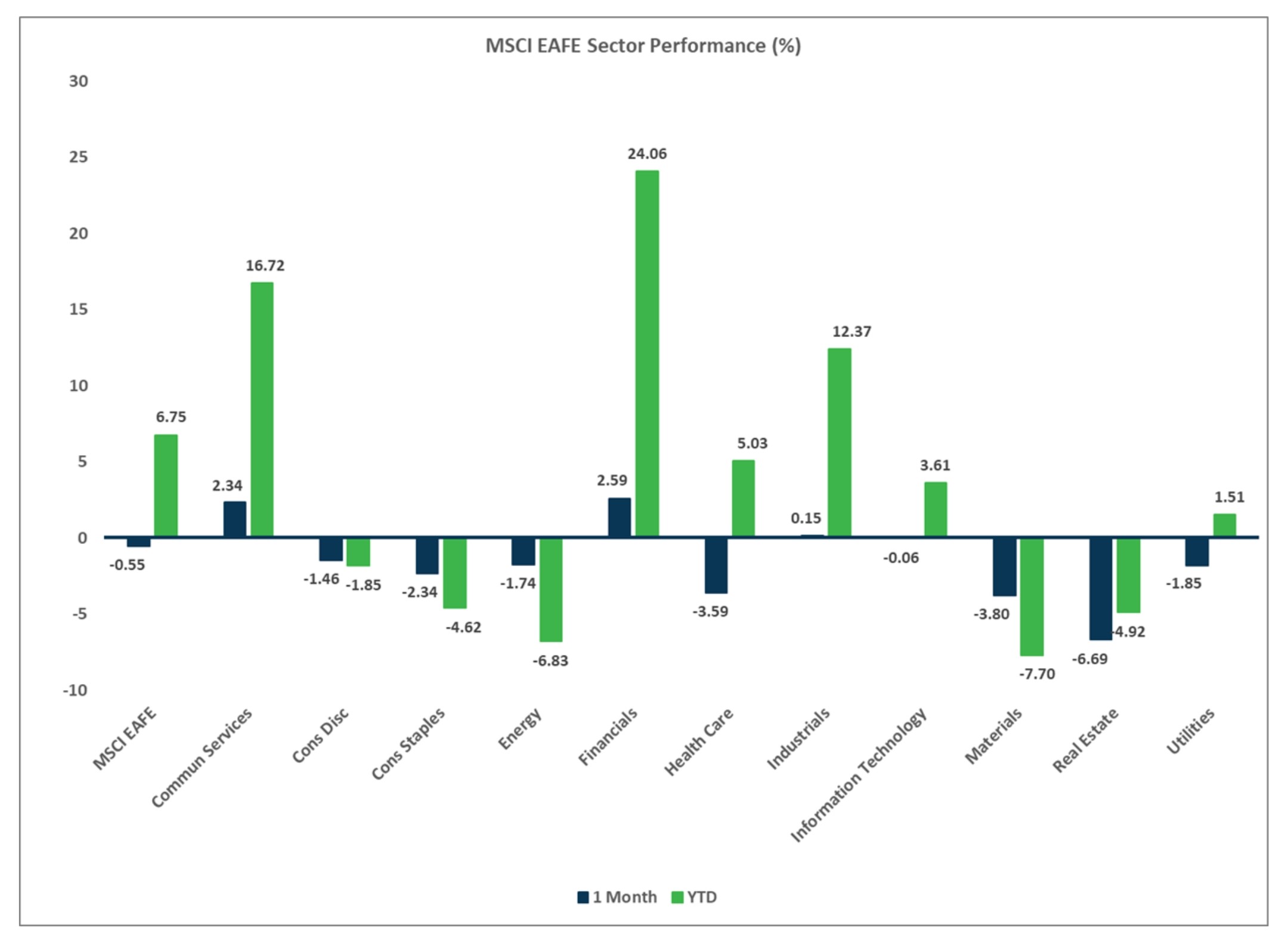

Non-U.S. Equities

- Developed markets outside the U.S. exhibited broad weakness in November, largely due to the stronger U.S. dollar.

- Japan was positive, although Europe and Asia were negative. Similar to the U.S., small caps beat large caps and growth beat value.

- USD strength cost investors 114 bps in EAFE markets and 347 bps in emerging markets.

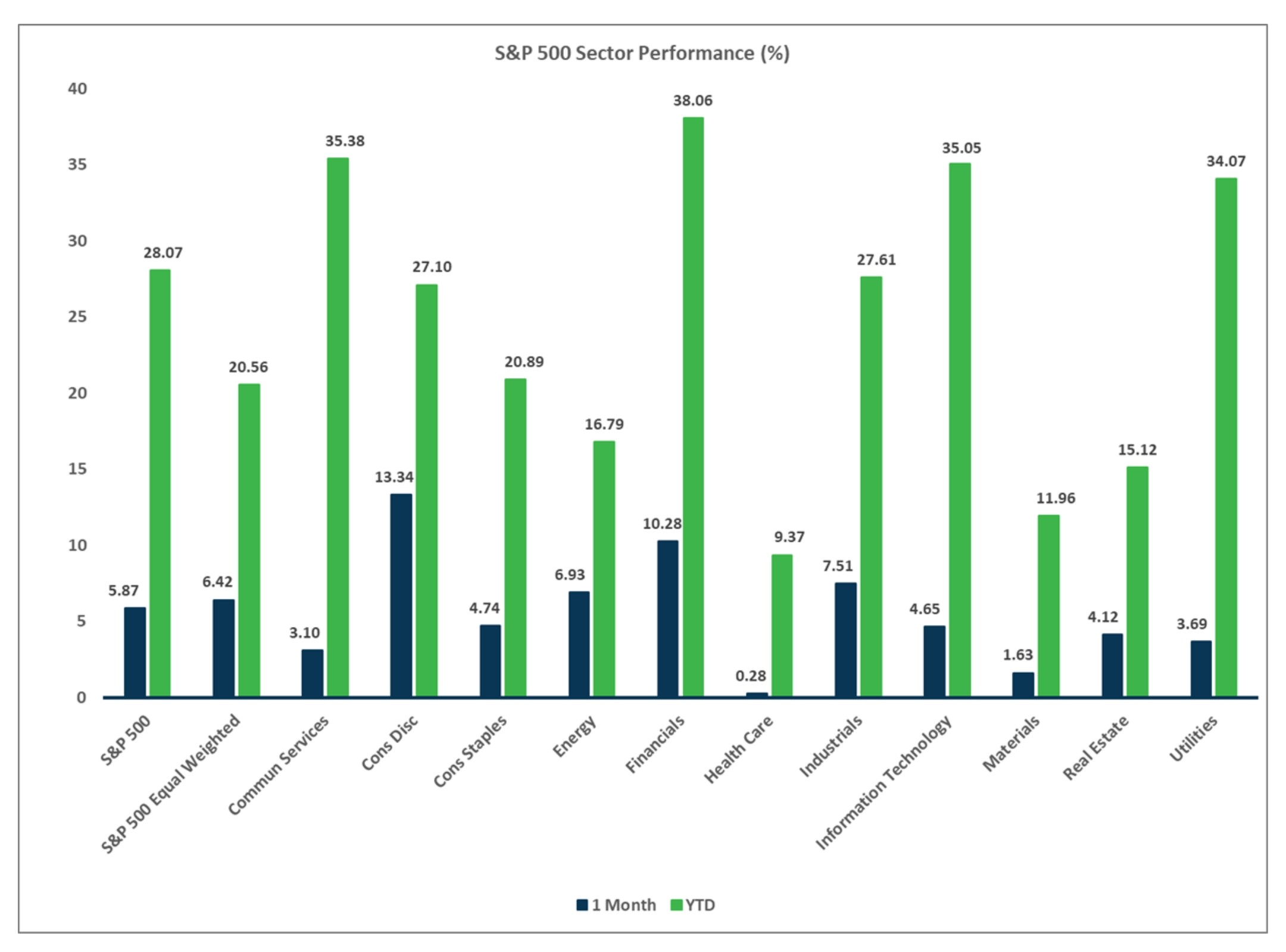

Sector Performance - S&P 500 (as of 11/30/24)

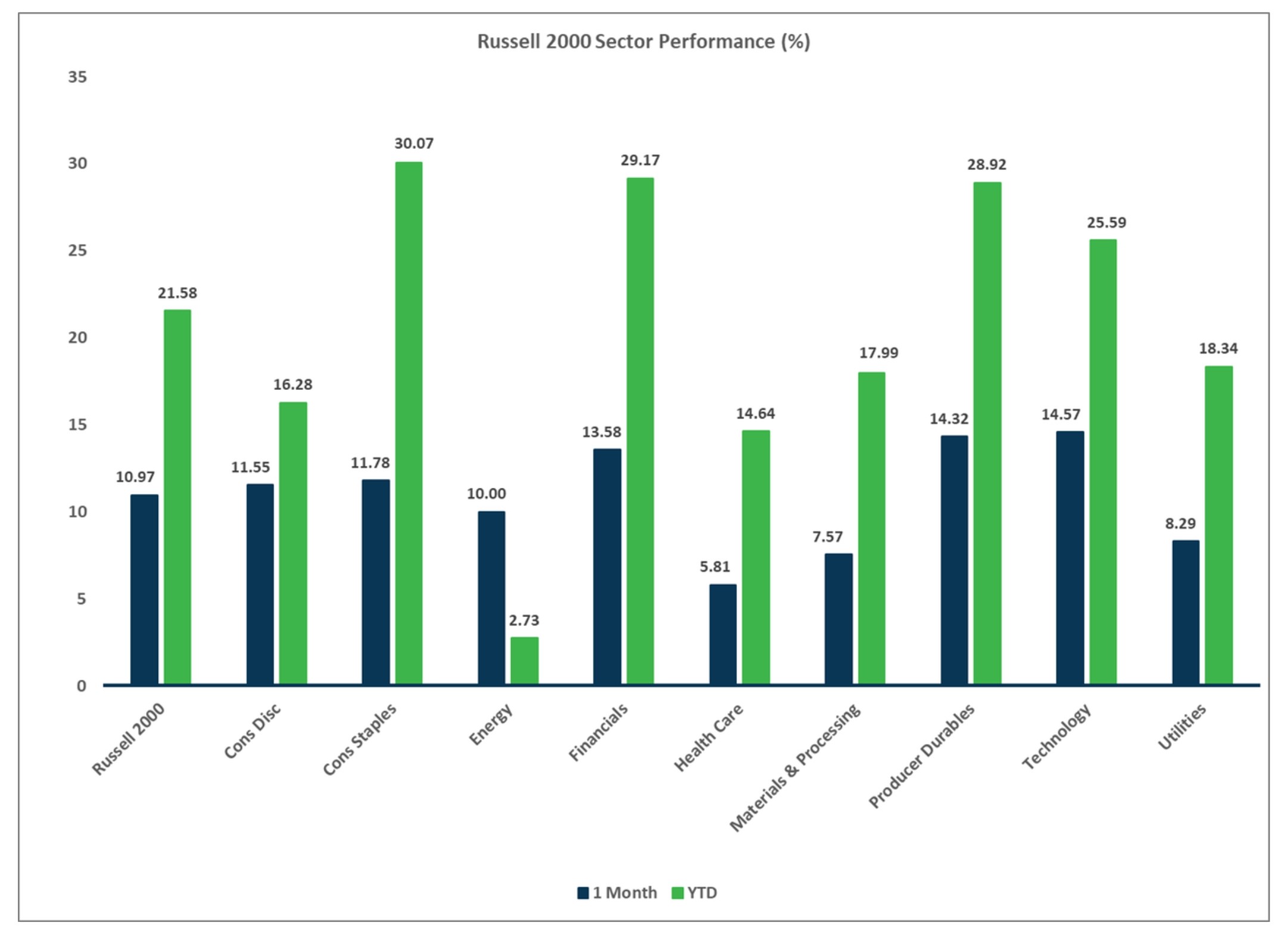

Sector Performance - Russell 2000 (as of 11/30/24)

Sector Performance - MSCI EAFE (as of 11/30/24)

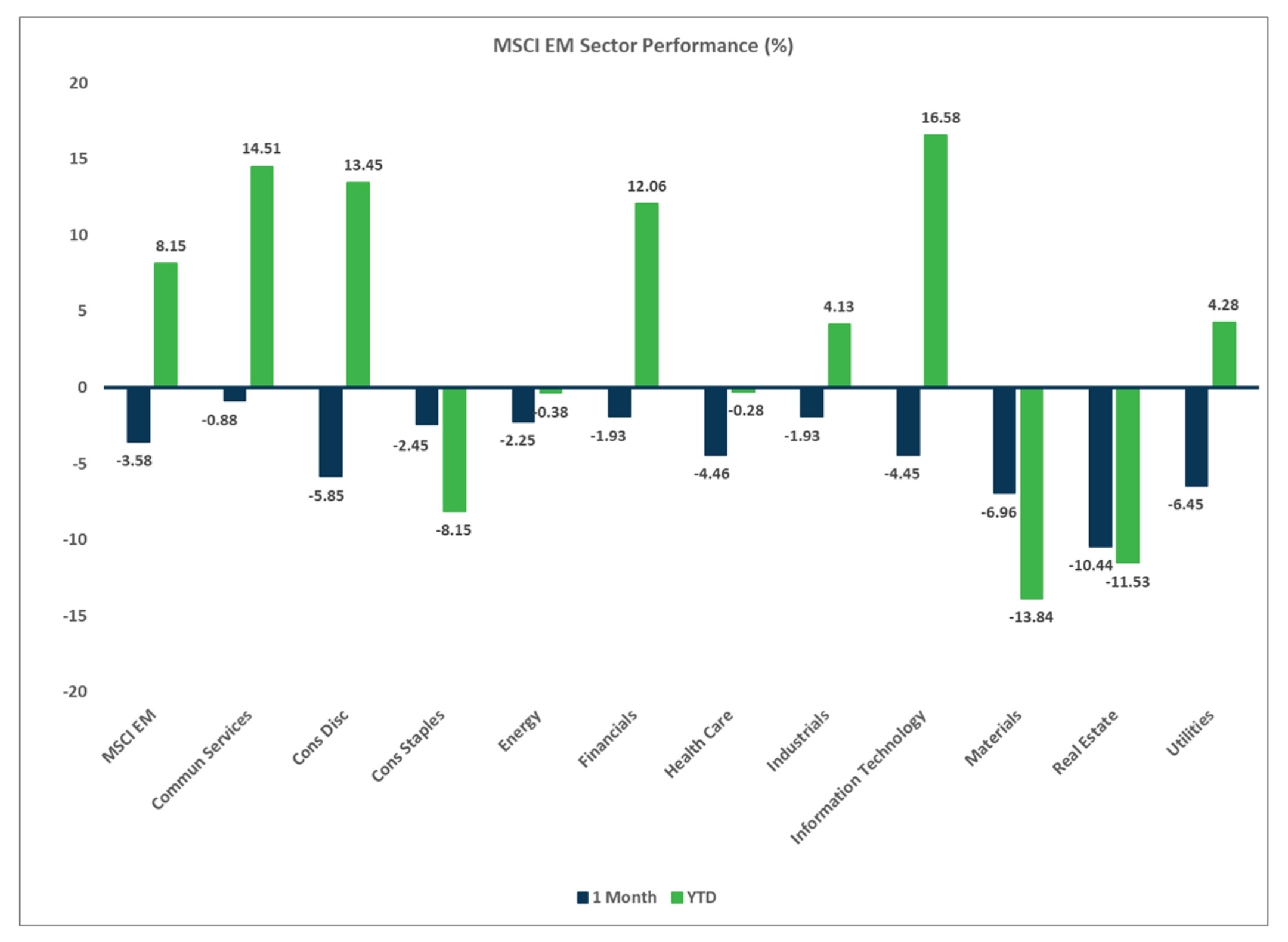

Sector Performance - MSCI EM (as of 11/30/24)