Market Flash Report December 2024

Economic Highlights

United States

- The November job report came in slightly above expectation with 227,000 new jobs added to the economy. The expectation was for 214,000 new jobs. The unemployment rate ticked up to 4.2% and the September and October reports were revised higher. Job gains were focused in health care (54,000), leisure and hospitality (53,000), and government (33,000). Average hourly earnings were a bit hotter than anticipated with growth of 0.4% M/M or 4% Y/Y. The broader U6 unemployment rate moved higher to 7.8%.

- The Federal Reserve preferred inflation gauge, the Personal Consumption Expenditures (PCE) Index, rose less than expected in November with the annual rate running at 2.4%, up from 2.3% in October. Core PCE held steady at 2.8%. Services prices generated most of the inflation for the month, rising 0.2% while goods were flat. Food and energy prices were both up 0.2%. Services have risen 3.8% over the past year. Consumer Price Index (CPI), which does not factor in substitutions, has run hotter than PCE inflation. Headline CPI was 2.7% in November and Core was steady at 3.3%.

- Retail sales in the U.S. increased 0.7% M/M in November 2024, following an upwardly revised 0.5% rise in October. The biggest increases were recorded for sales at motor vehicles and part dealers (+2.6%) and non-store retailers (+1.8%). In contrast, sales were flat at health and personal care stores and declined at miscellaneous store retailers (-3.5%); food services and drinking places (-0.4%); food and beverages stores (-0.2%); clothing (-0.2%); and general merchandise stores (-0.1%). Sales excluding food services, auto dealers, building materials stores and gasoline stations, which are used to calculate GDP, increased 0.4%.

- New orders for manufactured durable goods in the U.S. decreased 1.1% M/M in November 2024, following an upwardly revised 0.8% rise in October. Excluding transportation, durable goods fell 0.1%. Orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending, were up 0.7%, the biggest rise since August 2023.

Non-U.S. Developed

- The eurozone economy grew 0.4% Q/Q in Q3, above expectations and the fastest rate in over two years. Consumer spending, gross fixed capital formation and inventories were the main contributors, while net trade hurt growth as exports declined 1.5% versus imports that edged up 0.2%. Germany managed to avoid recession, while France expanded at a faster than anticipated growth rate. Spain led the way, while Italy and the Netherlands were weak.

- The eurozone composite Purchasing Managers Index (PMI) remained in contraction territory in December with a reading of 49.5, up from 48.3 in the prior month. Services rose back above 50 to a two-month high, but manufacturing fell to a one-year low. Most of the weakness came from Germany and France, the two largest eurozone economies. The rest of the eurozone posted solid increases in economic activity.

- Eurozone inflation accelerated to 2.2% in November, up from 2% in the prior month. Goods inflation increased slightly while the stickier services inflation fell modestly. Most of the increase was due to the base effect from lower prints a year ago.

- The Japanese economy grew an upwardly revised 0.3% Q/Q in Q3 (above the flash estimate of 0.2%), down from 0.5% in Q2. Business investment shrank by 0.1% and net trade subtracted 0.2%, as exports rose much less than imports. Private consumption increased 0.7% in Q3, driven primarily by rising wages, and Government spending also increased 0.1%.

Emerging Markets

- China's official Manufacturing PMI unexpectedly fell to 50.1 in December 2024 from November’s seven-month high of 50.3. It marked the third straight month of expansion in factory activity, following a series of support measures from The People's Bank of China (PBOC) since late September. The smaller company focused Caixin Manufacturing PMI fell to 50.5 in December from November’s 5-month high of 51.5. Both output and new orders expanded at slower rates while foreign orders shrank after increasing at the fastest pace for seven months in the prior month. Also, employment dropped for the fourth month. Exports dragged on demand amid mounting uncertainties stemming from the overseas economic environment and global trade.

- China’s official Non-Manufacturing PMI hit a nine-month high of 52.2 in December, up from 50.0 in November. The latest reading indicated that the recent flurry of stimulus measures by the government and the central bank is beginning to yield results, although progress remains subdued amid ongoing economic headwinds.

- Singapore's economy grew by 4.3% Y/Y in the fourth quarter of 2024, slowing from a 5.4% expansion in the third quarter but exceeding market expectations of 3.8%. For the full year, the economy expanded by 4%, outperforming the 1.1% growth seen in 2023 and surpassing forecasts of 3.5%.

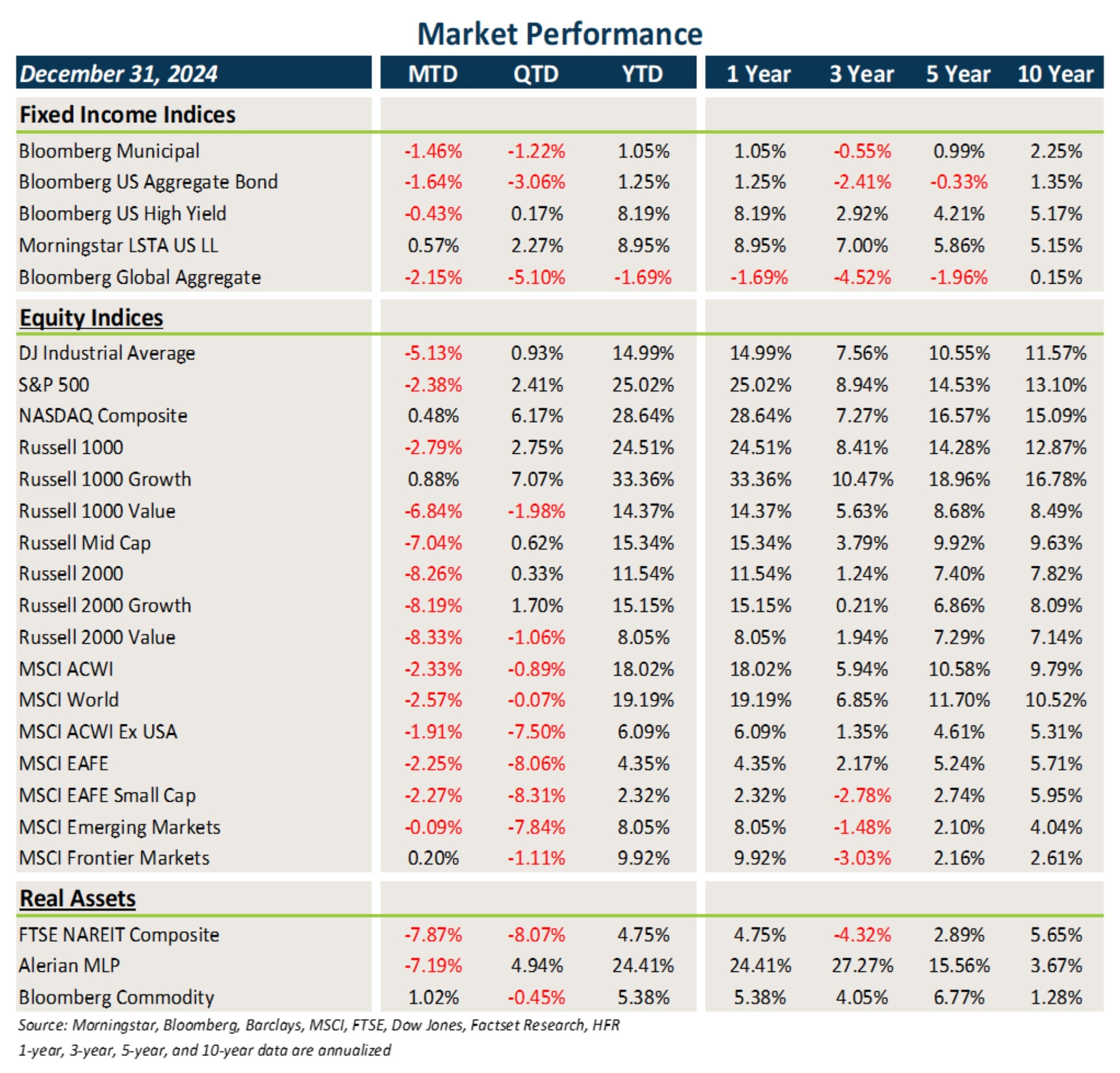

Fixed Income

- Yields continued their march higher in December, resulting in losses for core fixed income and municipal bonds.

- Credit was mixed as tight spreads were somewhat offset by the backup in rates. It continues to be an environment of clipping coupons across credit.

- Bonds outside the U.S. were hit again by higher yields and the stronger dollar.

U.S. Equities

- U.S. equities fell to end the year after starting December on a high note. Growth stocks managed to buck the trend and the U.S.

- Growth beat value in December and large caps trounced small caps.

- Higher rates pressured small cap companies and after surging following the election, they fell to end 2024.

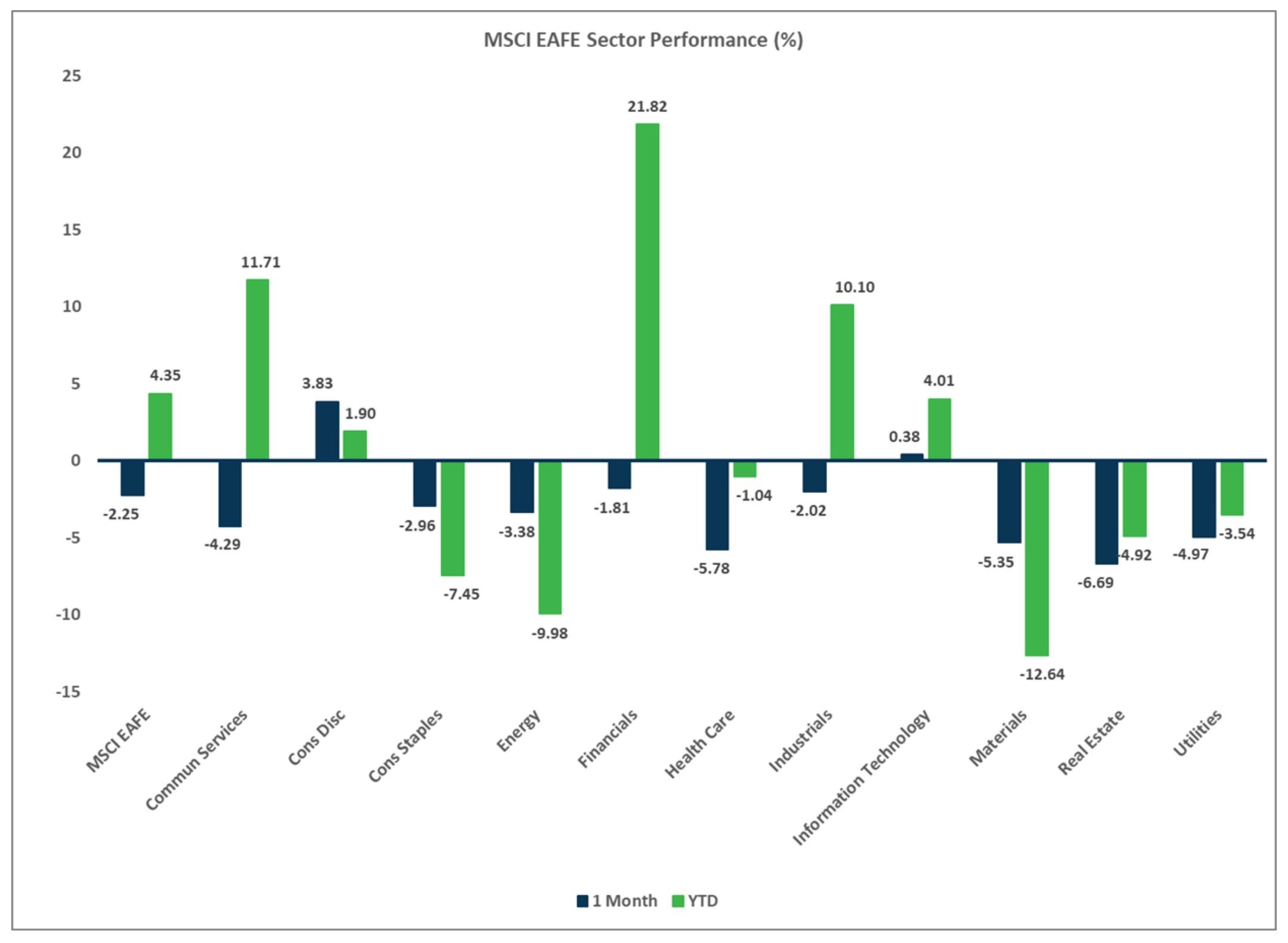

Non-U.S. Equities

- Developed markets outside the U.S. exhibited broad weakness in December, largely due to the stronger U.S. dollar.

- Japan outperformed Europe and similar to the U.S., large caps beat small caps. Value did manage to outperform growth across EAFE markets.

- USD strength cost investors 268 bps in EAFE markets and 132 bps in EM markets.

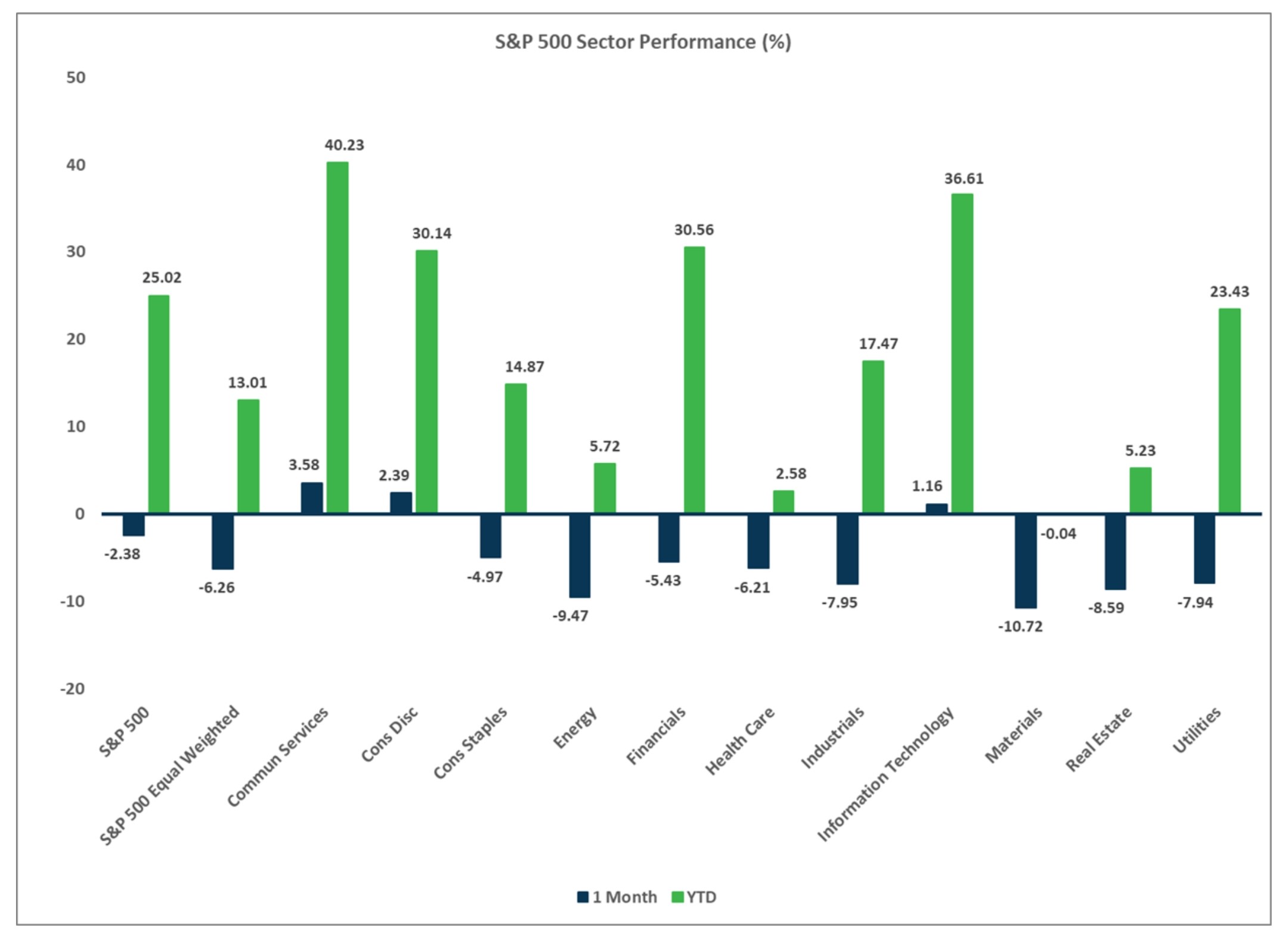

Sector Performance - S&P 500 (as of 12/31/24)

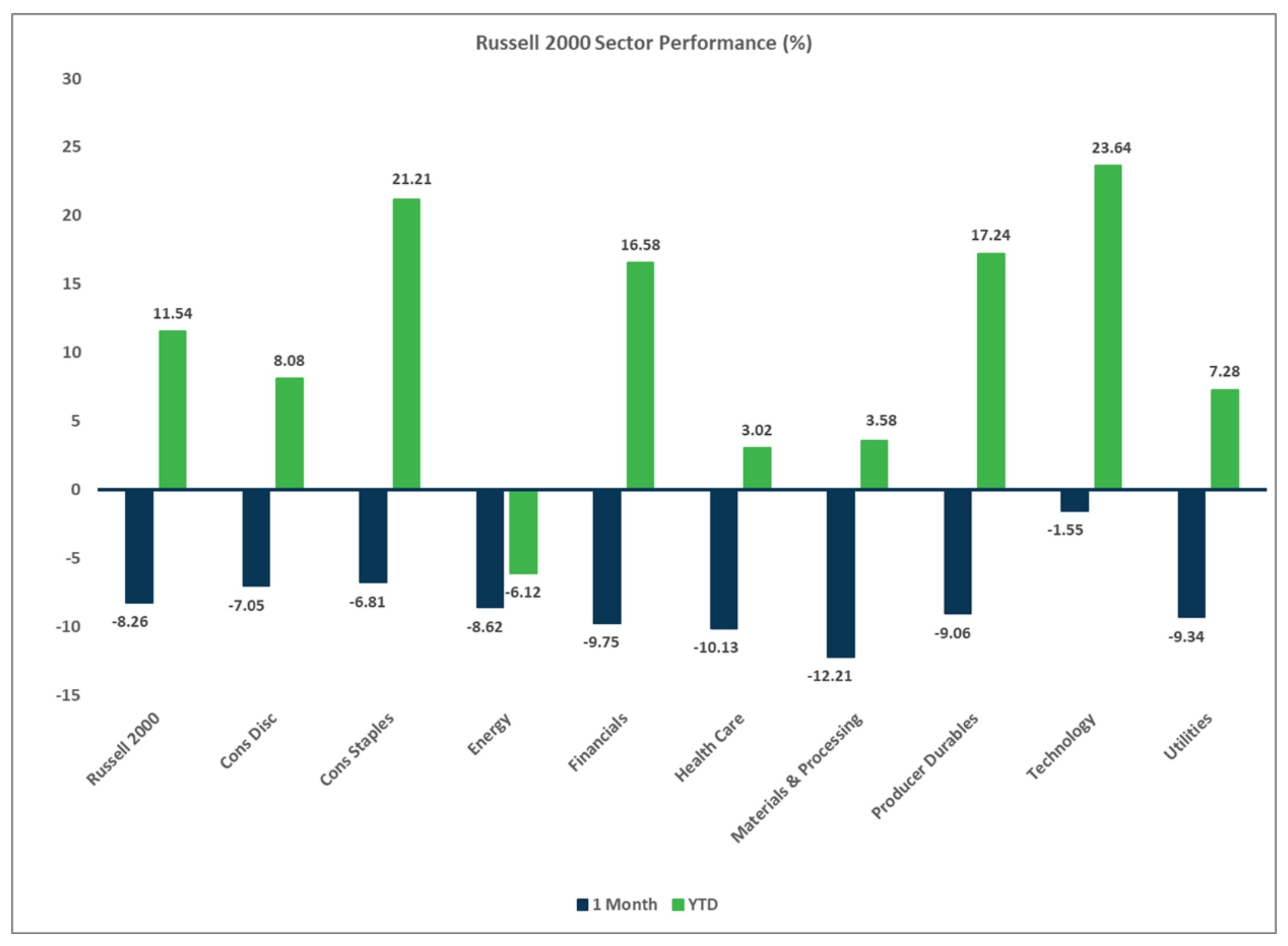

Sector Performance - Russell 2000 (as of 12/31/24)

Sector Performance - MSCI EAFE (as of 12/31/24)

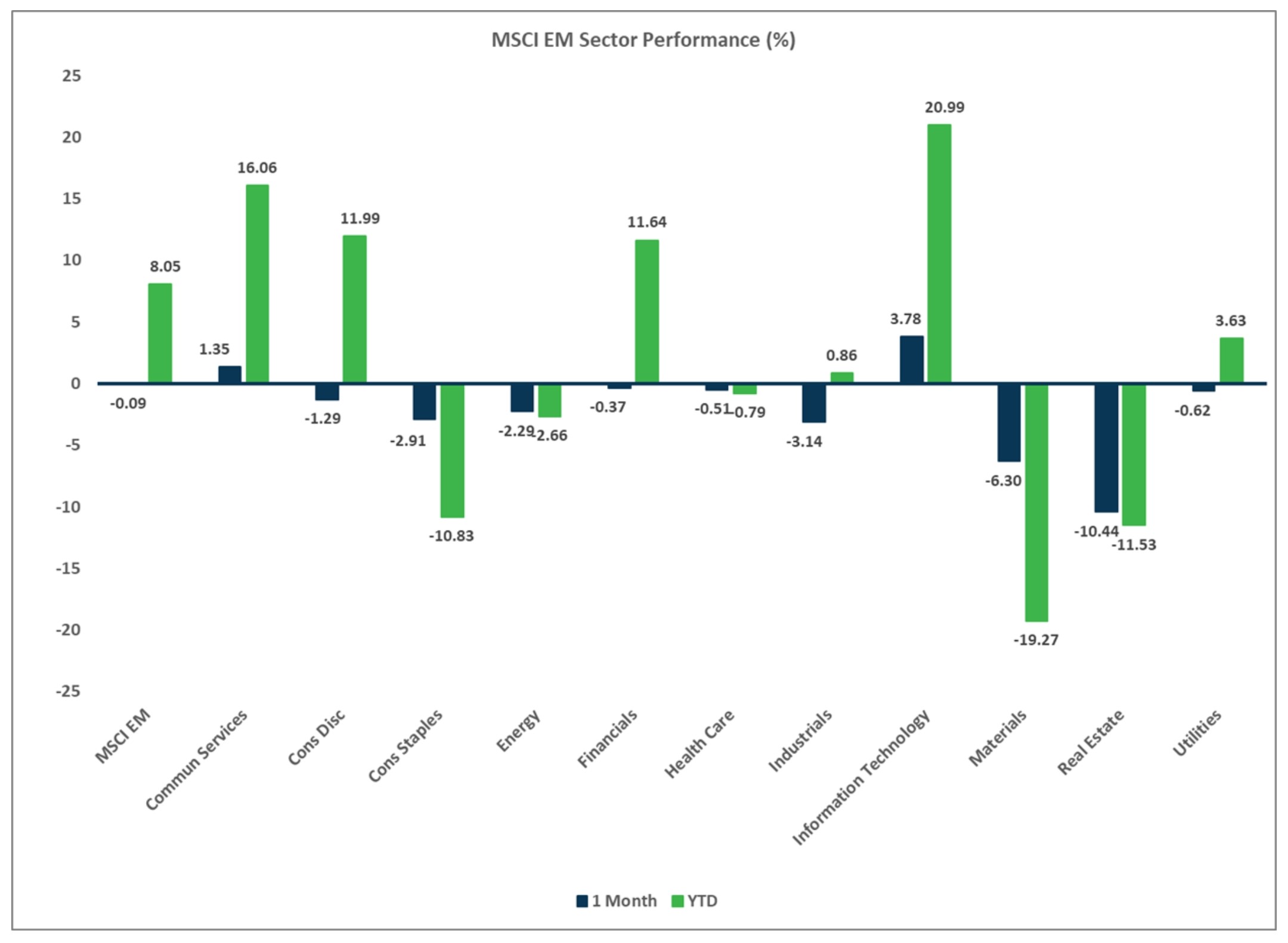

Sector Performance - MSCI EM (as of 12/31/24)