Market Flash Report February 2025

Economic Highlights

United States

- The January employment report was a mixed bag with slower-than-expected hiring, but an unemployment rate that unexpectedly fell. U.S. employers added 143,000 new jobs for the month, down from an upwardly revised 307,000 in December and below the 169,000 forecast. The unemployment rate fell to 4%, largely due to an uptick in the labor participation rate to 62.6%. The broader U6 unemployment rate held steady at 7.5%. Nearly 2 million people were added to the labor force as a result of annual adjustments for population growth and immigration. Wage growth was hotter than expected at 0.5% M/M or 4.1% Y/Y. Economists expect 133,000 new jobs to be added to the economy in February, with the unemployment rate holding steady at 4%.

- The U.S. economy grew 2.3% in Q4 2025, but a string of weaker data points have sent Q1 estimates lower. The Atlanta Federal Reserve has a Q1 estimate of -2.8%.

- The Personal Consumption Expenditure (PCE) price index, the Fed’s preferred inflation measure, increased 0.3% M/M in January or 2.5% Y/Y. Core PCE also rose 0.3% M/M, but the annual rate of 2.6% fell from 2.9% in December. Headline Consumer Price Index (CPI) came in at an annual rate of 3% in January and 3.3% for Core CPI. The Fed prefers PCE over CPI because it is broader-based and adjusts for changes in consumer behavior, placing less emphasis on housing and shelter costs.

- Retail sales dropped 0.9% in January, the biggest decrease since March 2023, after an upwardly revised 0.7% increase in December. Retail sales increased 4.2% year-on-year in January. Two major snowstorms and the California wildfires were cited as reasons for the weaker-than-expected report, but concern over inflation and tariffs could also be responsible.

- Manufacturing in the U.S. remained in expansion territory in February, with the ISM Manufacturing PMI coming in at 50.3 (down from 50.9 in January). New orders, production and employment all weakened, but the prices component surged higher.

Non U.S. Developed

- The eurozone composite PMI was unchanged in February. The headline reading was 50.2 and the underlying services component weakened slightly while the manufacturing component strengthened, albeit from 46.6 in January to 47.3 in February. New orders continued to fall and companies again lowered their staffing levels amid muted demand. Economic output in the eurozone is barely moving. The milder recession in the manufacturing sector is slightly being overcompensated for by minor growth in the services sector. Political uncertainty in Germany and France only further complicates the outlook.

- Inflation in the eurozone crept higher last month to an annualized rate of 2.5%. Energy costs accelerated sharply, jumping 1.8% Y/Y. Core inflation sits at 2.7% and services inflation fell to 3.9%. The European Central Bank cut rates by another 25 bps in early February, but future rate cuts will depend on the path of inflation and potential tariffs.

- Japan’s Q4 GDP beat expectations with an increase of 0.7% Q/Q. Full-year GDP growth slowed to 0.1%, a sharp decline from the 1.5% growth seen in 2023. A jump in exports helped boost GDP, while domestic demand was a drag on growth. Growth comes as the Bank of Japan raised rates to their highest level since 2008 at 0.5%. Weak domestic demand remains a major concern.

Emerging Markets

- China’s factory activity expanded at its fastest pace in three months to 50.8 in February based on the Caixin/S&P Manufacturing PMI. This was an increase from 50.3 in January and highlighted the return to work after the Lunar New Year holiday. New export orders rose at the fastest pace since April 2024, perhaps due to U.S. importers front-running tariffs in anticipation of even higher levies scheduled to take place on March 4.

- The official manufacturing PMI rose to 50.2 in February from 49.1 in January, according to the National Bureau of Statistics. The non-manufacturing PMI, which includes services and construction, also climbed to 50.4 from 50.2 in January. The non-manufacturing subindices suggest things may be a little less rosy than what headline numbers suggest. Most of the subindices, including new orders and new export orders, contracted.

- India’s economy picked up in the most recent quarter as manufacturing and government spending regained momentum. The world’s fifth-largest economy grew 6.2% Y/Y in Q4, ahead of the 5.6% growth rate reported in the prior quarter. The Indian economy benefited from strength in manufacturing and private consumption.

- Brazil’s economy grew 3.5% in 2024, but the government just cut its 2025 growth forecast to 2.3% from 2.5%. The country has been fighting rising inflation and the result has been higher interest rates and tighter monetary policy.

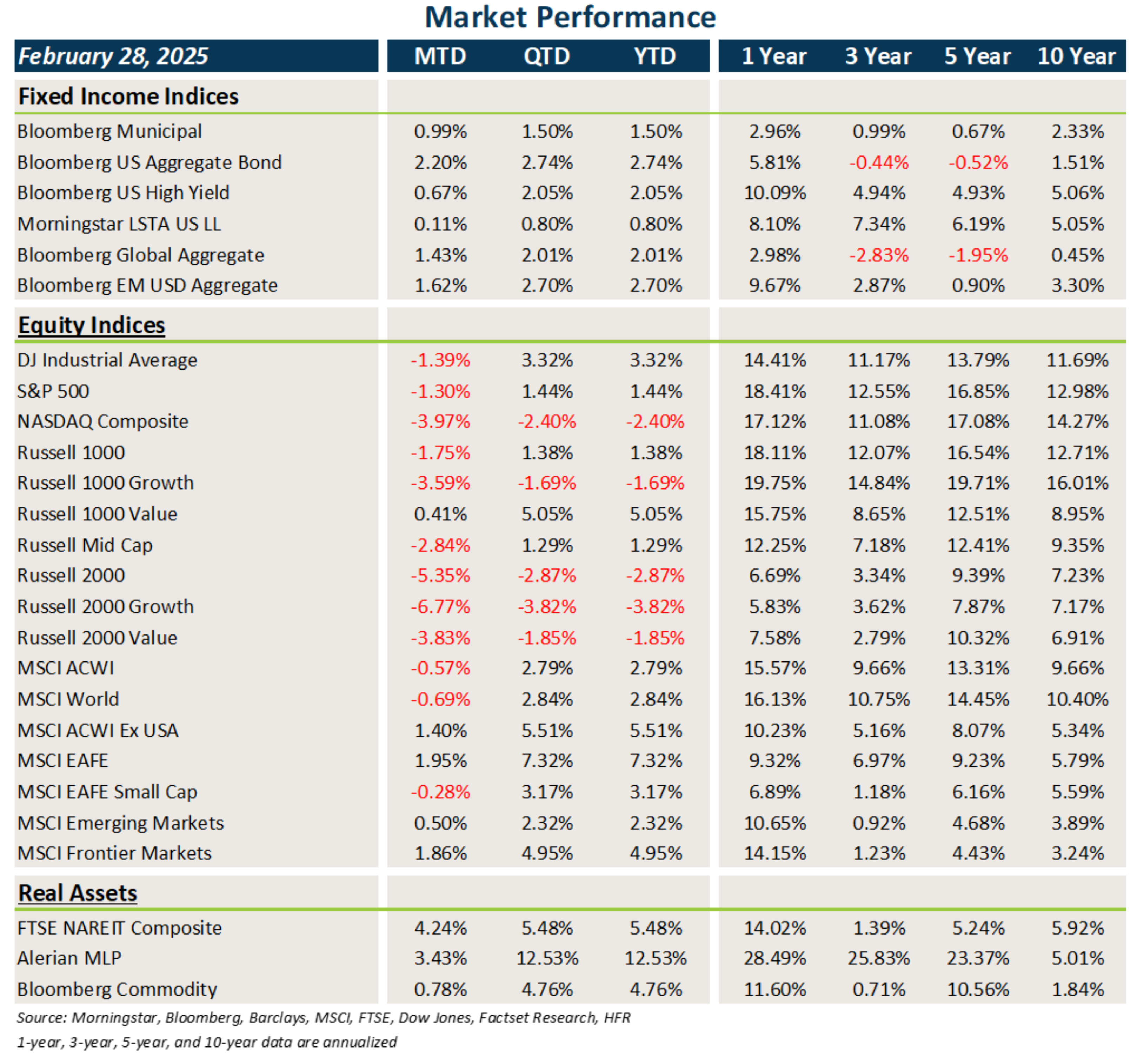

Fixed Income

- Treasury and other sovereign debt yields declined in February, fueling gains in core fixed income and municipal bonds.

- Credit continued to benefit from clipping higher coupons amidst the benign corporate credit environment. Spreads widened slightly last month.

- Bonds outside the U.S. got an added boost from the weaker U.S. dollar.

U.S. Equities

- U.S. equities fell in February as investors questioned U.S. economic growth, geopolitical tensions and the impact of tariffs.

- Growth/tech was the weakest style segment along with small caps, which lagged large caps.

- The February weakness occurred despite strong earnings growth numbers.

Non U.S. Equities

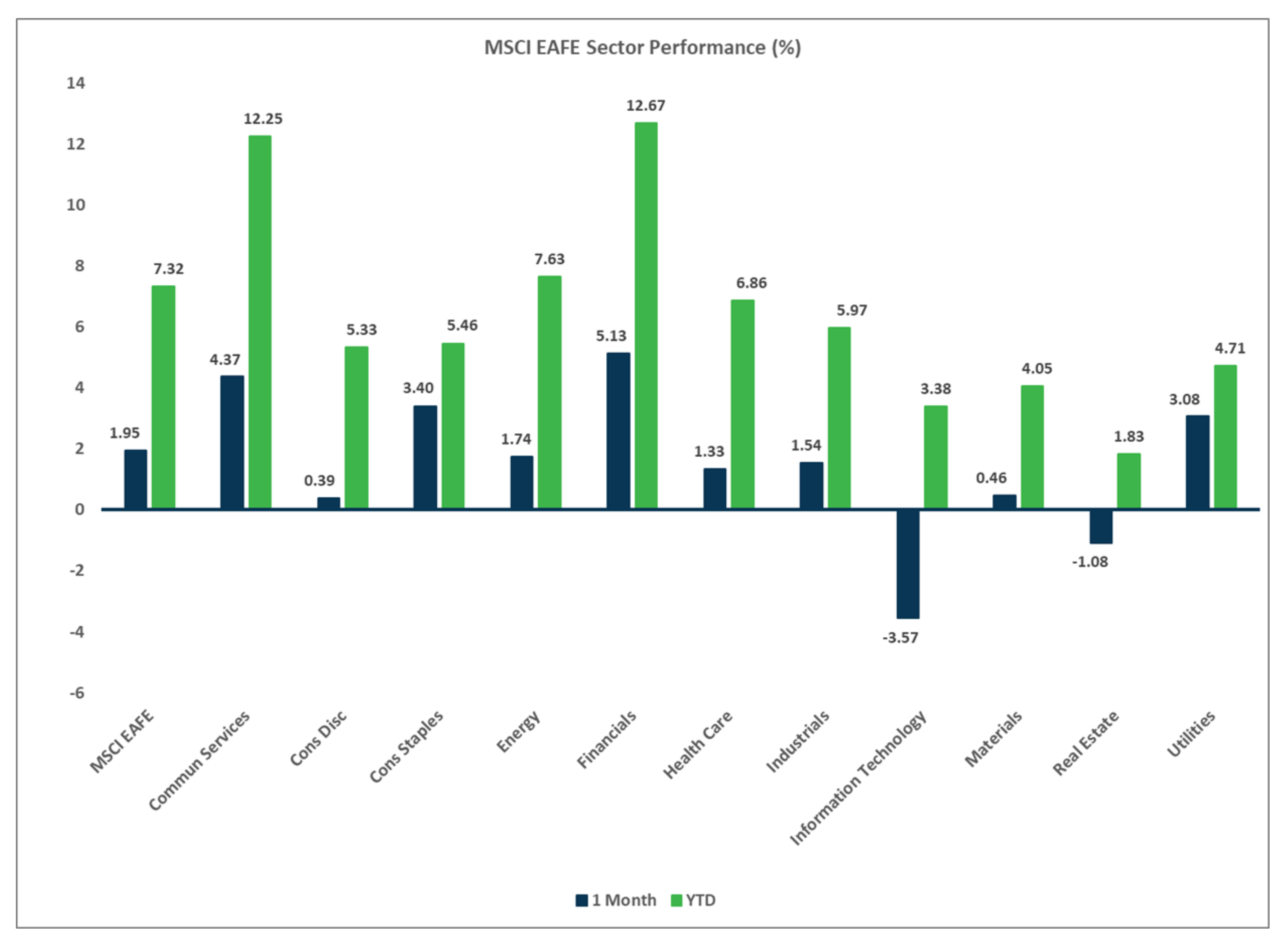

- Developed markets outside the U.S. exhibited relative strength versus the U.S., driven by financials and other value sectors.

- Similar to what occurred in the U.S., small caps lagged large caps within EAFE and emerging markets (EM).

- EMs eked out a small positive return in February, largely driven by China.

- USD weakness boosted EAFE returns by about 100 bps. EM currencies were mixed vs the USD so the impact was actually -25 bps.

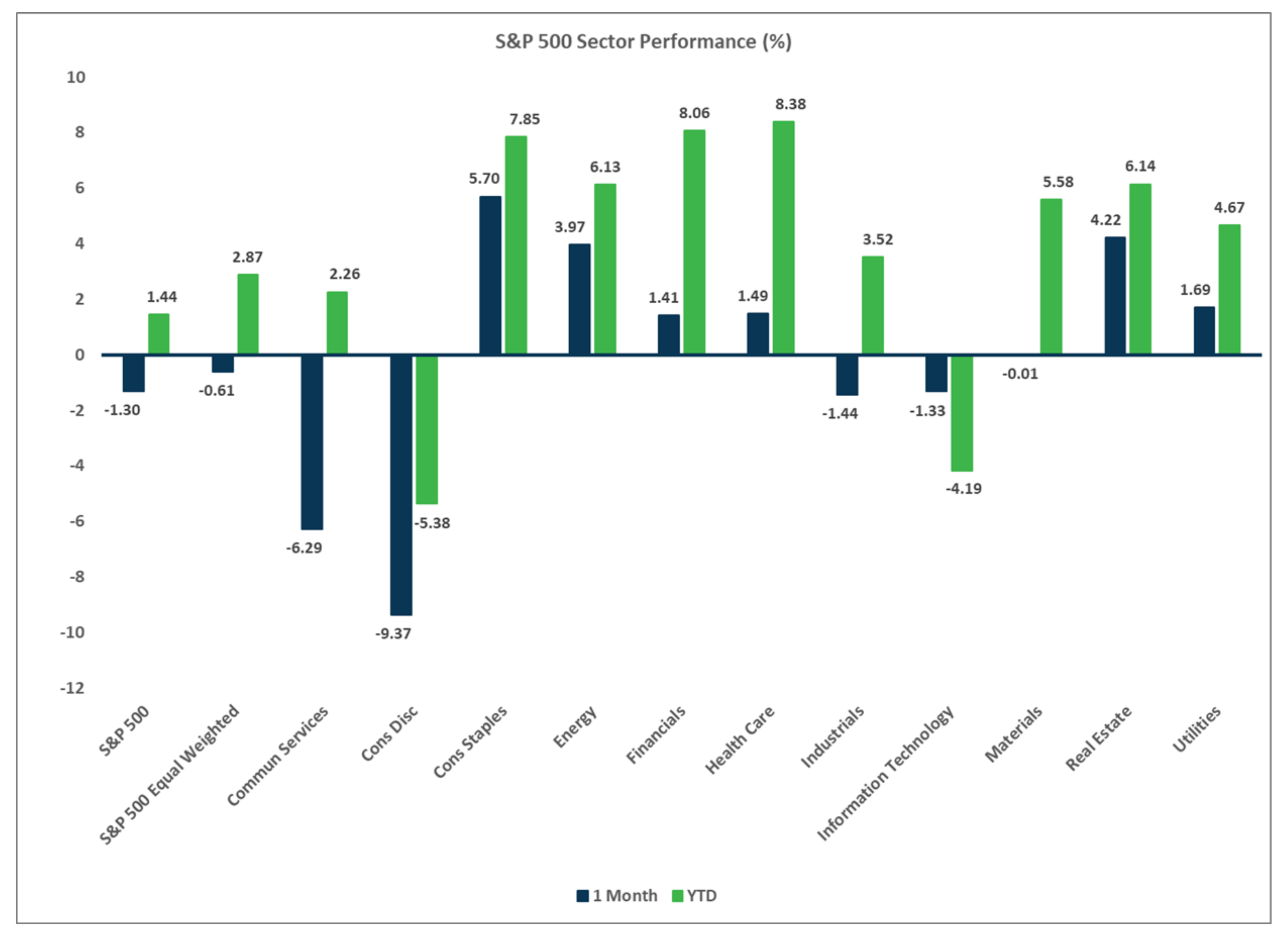

Sector Performance - S&P 500 (as of 02/28/25)

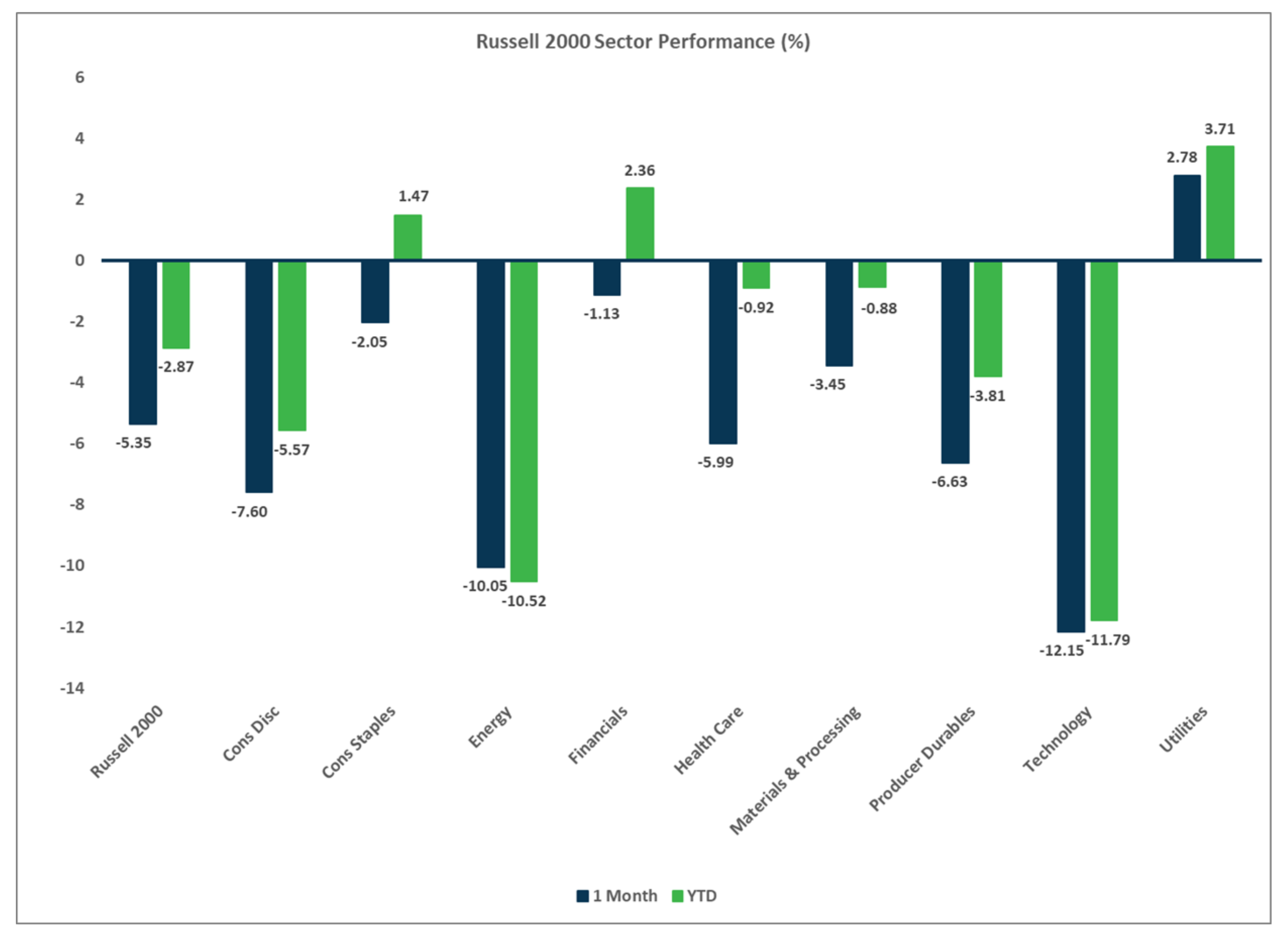

Sector Performance - Russell 2000 (as of 02/28/25)

Sector Performance - MSCI EAFE (as of 02/28/25)

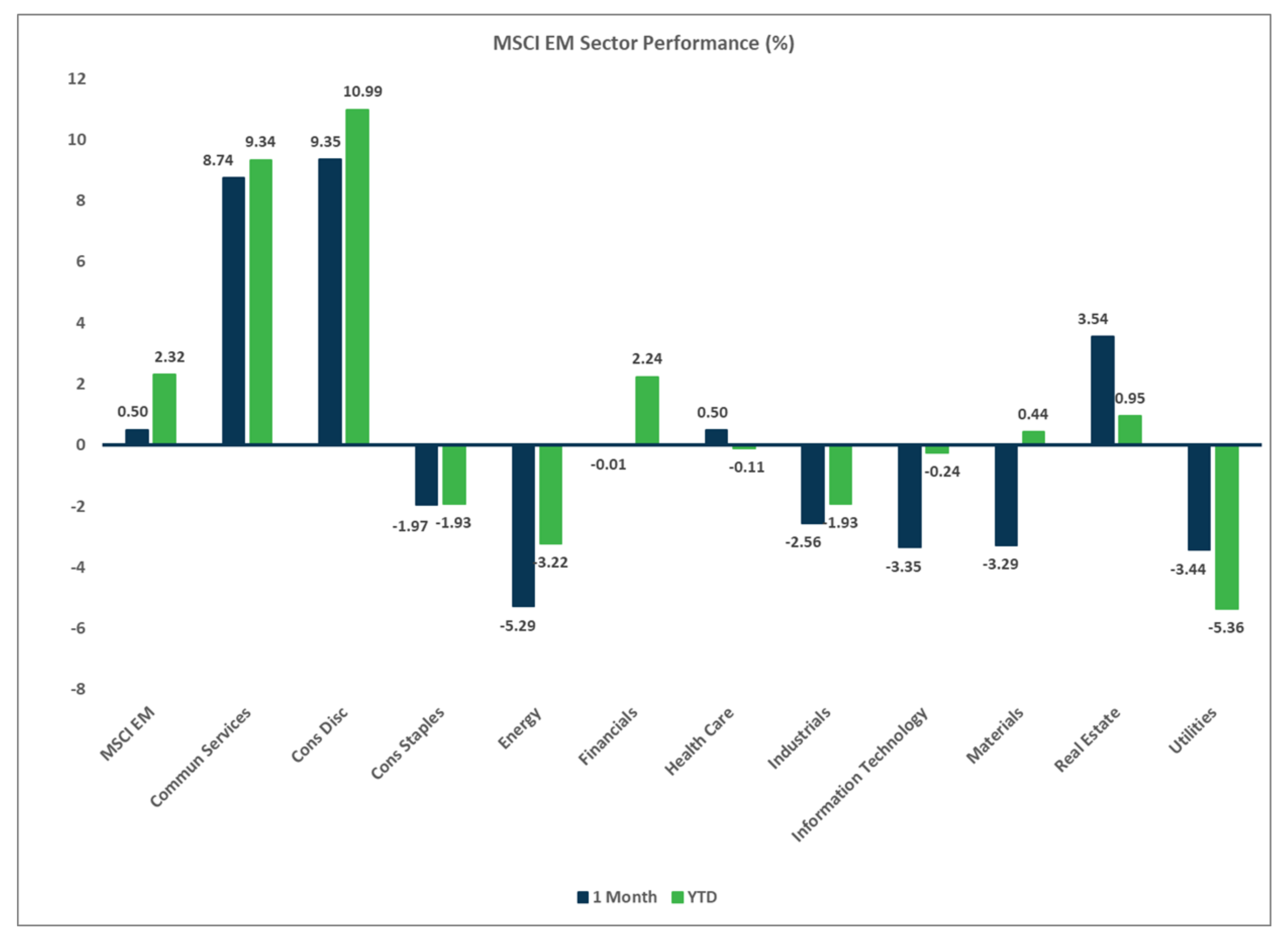

Sector Performance - MSCI EM (as of 02/28/25)