Capital Markets Playbook | Q2 2024

2024 Q1 Summary

- Equity markets experienced yet another quarter of positive returns in the first quarter of 2024 as economic growth remained strong.

- All major equity asset classes were up in the first quarter. U.S. large cap stocks led most major equity asset classes (+10.2%).

- Enthusiasm around artificial intelligence (“AI”) provided a huge boost to “growth” stocks in the U.S. and abroad.

- Broad based fixed income markets posted losses in the first quarter of 2024 as interest rates moved higher.

- High Yield continued to lead all major fixed income categories in the first quarter (+1.5%) as credit spreads remain tight.

2024 Q1 in Review

- 2024 Q1 U.S. Macroeconomic Review

- The Federal Reserve kept its short-term policy rate to 5.25-5.50% and signaled that it is possible that its short-term policy rate will not be cut as much as the market expects in 2024.

- High interest rates (and the prospect of fewer rate cuts in 2024) did not have a meaningful impact on consumer spending, unemployment or economic growth.

- Consumer spending growth was much stronger than expected in Q1.

- Unemployment, currently at 3.9%, increased slightly but remains near multi-decade lows.

- Inflation, which had declined meaningfully in 2023, did not decline as much as expected in Q1.

- Economic growth in the U.S. in Q1 was likely better than expected.

- 2024 Q1 Equity Market Review

- Equity market volatility remained low and global equity markets produced strong gains.

- Many global equity markets reached all-time highs.

- In the U.S., the Dow Jones, Nasdaq and S&P 500 indices hit fresh all-time highs.

- In Japan (Nikkei), stocks reached a new all-time high for the first time since 1989.

- U.S. large cap stocks led all major equity asset classes.

- U.S. large cap outperformed U.S. small cap, international equities, and emerging market equities.

- “Growth” stocks outperformed “value” stocks.

- 2024 Q1 Fixed Income Market Review

- Volatility in fixed income markets declined in Q1 but remains elevated.

- The yield curve remained inverted and the 10-year yield remained fairly range-bound.

2024: Expectations for the Year Ahead

- 2024 U.S. macroeconomic preview

- Expected case

- Consumer spending grows at a slower pace. An outright decline in consumption growth is not expected.

- Business investment slows, but an outright decline in business investment is not expected.

- Unemployment increases at the margin and remains below 5%.

- Economic growth will be below its long-term growth rate of 2%.

- Inflation will continue to moderate but it will not reach the Federal Reserve’s 2% inflation target in 2024.

- The Fed cuts rates by at least 0.75%.

- Expected case

- 2024 equity market preview

- Expected case

- Equity markets are more volatile in 2024 then they were in 2023.

- Companies with strong balance sheets, reliable cash flows and consistent earnings may outperform in 2024.

- International and emerging market equities may outperform U.S. equities as the Fed cuts rates and the dollar weakens.

- Expected case

- 2024 fixed income market preview

- Expected case

- Volatility in fixed income markets will “normalize.”

- The U.S. Treasury yield curve will flatten, but yield curve inversion may persist throughout most of the year.

- Shorter duration bond yields will fall as the Fed cuts its short-term policy rate.

- Intermediate and long-term yields may remain “range-bound.”

- Credit spreads on high-risk fixed income (i.e. High Yield) will widen as consumer spending, business investment and economic growth slow.

- Expected case

Risks to the "Expected Case" in 2024

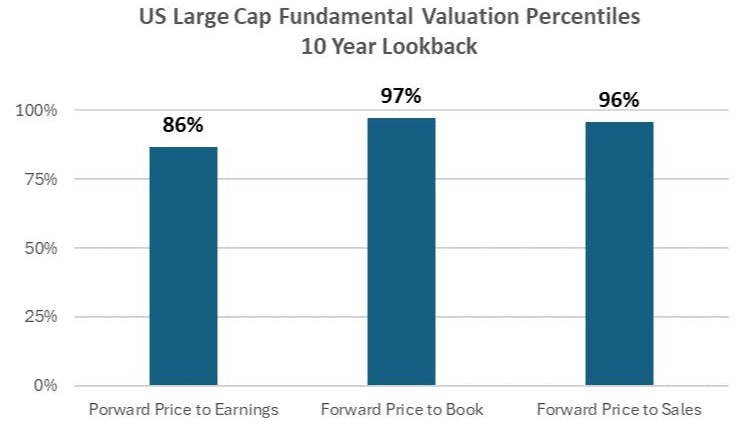

Strong Equity Returns Have Led to Higher Valuations

- Fundamental valuations for most parts of the global equity market have moved higher in recent quarters.

- In recent quarters, U.S. large cap stocks have become more and more expensive from a fundamental valuation perspective.

- Nearly every fundamental valuation metric shows that U.S. large cap stocks are near their most expensive levels in a decade.

- Takeaway

- Long-term investors should stay invested in U.S. large cap stocks but taking some “gains off the table” is prudent.

Strong Equity Returns Have Led to Higher Valuations

- Within U.S. large cap equities, technology stocks became even more expensive over the past few quarters as investor enthusiasm over artificial intelligence has grown.

- The chart illustrates the relative valuation percentiles of U.S. technology stocks to other sectors of the equity market.

- Compared to nearly every other U.S. equity sector, U.S. technology stocks are near their most expensive levels over the past 10 years.

- Takeaway

- Within U.S. large cap equities, long-term investors should consider “taking gains” in technology stocks first and foremost.

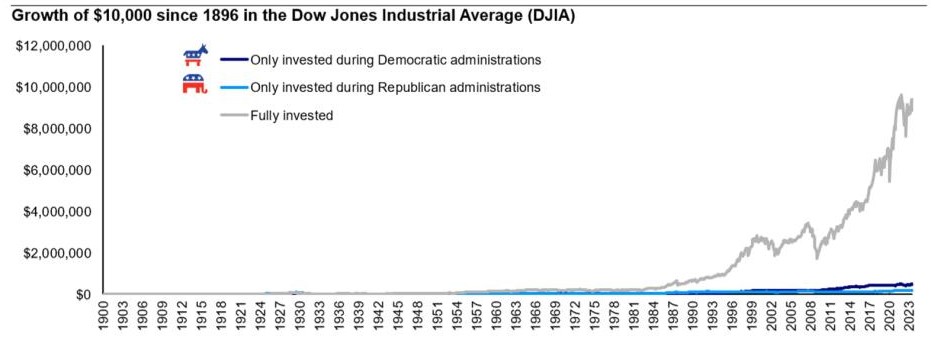

2024 Elections

- With campaign season ramping up, investors should expect a lot of “noise” around how certain political agendas may impact market returns.

- The chart illustrates that investors would be wise to avoid making investment decisions based on potential changes in U.S. government policy.

- Takeaway

- Long-term investors should avoid making investment decisions based on what happens with elections in the U.S. Staying invested in the market is the key to building wealth over the long term.

2024 Theme: Slowing Economic Growth

- The U.S. is coming off a year of surprisingly strong economic growth in 2023. It will be challenging for the U.S. economy to grow as strongly over the next year or two.

- Although economic growth in Q1 may have been stronger than anticipated, it is likely that economic activity in the U.S. will be “below trend” in 2024 and 2025.

- The U.S. may avoid a recession in 2024, but the probability of an economic contraction in 2024 cannot be ruled out.

- Scenerios:

- Best Case

- Economic activity in the U.S. is above its long-term trend rate over the next two years.

- Expected Case

- Economic activity in the U.S. is at or below its long-term trend rate over the next two years.

- Worst Case

- Economic activity is well below the long-term trend rate over the next two years.

- The U.S. enters into a recession that is likely “mild” by historical comparisons.

- Best Case

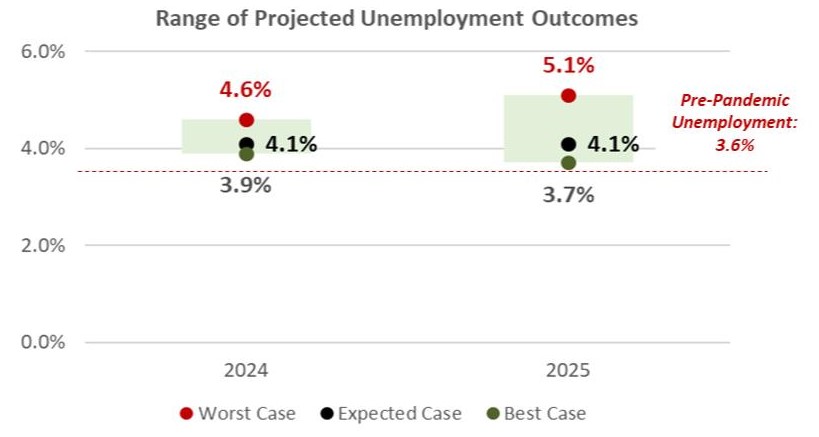

2024 Theme: Higher Unemployment, Slower Wage Growth

- The labor market has begun to cool in recent months, but unemployment remains near historical lows (3.9%).

- Surveys indicate, however, that businesses plan to slow hiring activity in 2024.

- Scenarios:

- Best Case

- Unemployment is largely unchanged from its current level and remains near historical lows over the next two years.

- Expected case

- As economic growth slows in the U.S., unemployment ticks higher, but remains below 4.5% over the next two years.

- Worst case

- Unemployment exceeds 5% by the end of 2025 as a result of meaningfully slower economic growth.

- Best Case

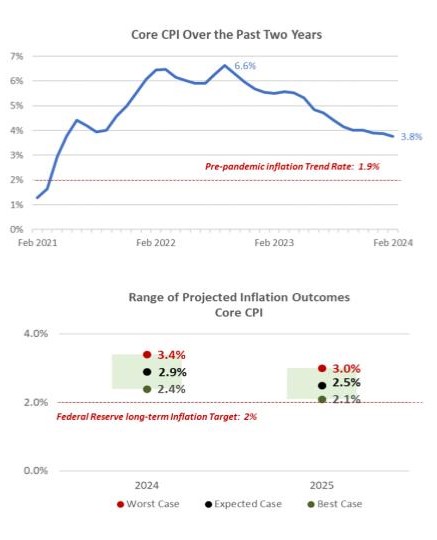

2024 Theme: Slowing Inflation

- Inflation had been moderating at a relatively fast pace since the fall of 2022, but that trend has stalled in Q1.

- In the first two months of 2024, inflation was stronger than expected, which has created uncertainty over how quickly the Federal Reserve may cut interest rates.

- Senarios:

- Best case

- Inflation falls as a result of slower economic growth and is close to the Fed’s long-term inflation target before the end of 2025.

- Expected case

- Inflation continues to moderate slowly and is slightly higher than the Fed’s 2% target by the end of 2025.

- Worst case

- Inflation continues to be sticky throughout the aggregate economy and remains well above the Fed’s long-term inflation target through the end of 2025.

- Best case

2024 Theme: Market Volatility

- Equity market volatility was well below its long-term average in 2023, while volatility in fixed income markets was much higher than normal.

- Equity market volatility is likely to increase in 2024, while fixed income volatility is expected to decline as the Federal Reserve begins to cut its short-term policy rate.

- Takeaways:

- Market volatility is, by definition, a function of uncertainty.

- Volatility will decline as market participants have more clarity into the future of inflation, monetary policy, economic growth, etc.

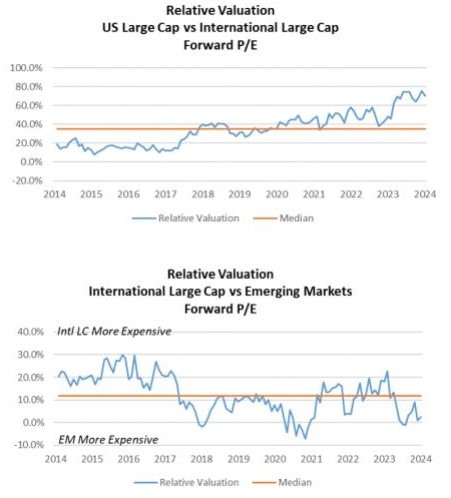

2024 Playbook: International Equity

- Fundamental valuation metrics suggest that U.S. equities are “expensive” on a relative basis.

- International equities and emerging market equities are more attractive than U.S. large cap on a relative valuation basis.

- Economic considerations

- If economic growth surprises to the upside in 2024, international and emerging market equities will likely outperform U.S. equities.

- If there is a global economic recession in 2024, U.S. equities will likely outperform international and emerging market equities.

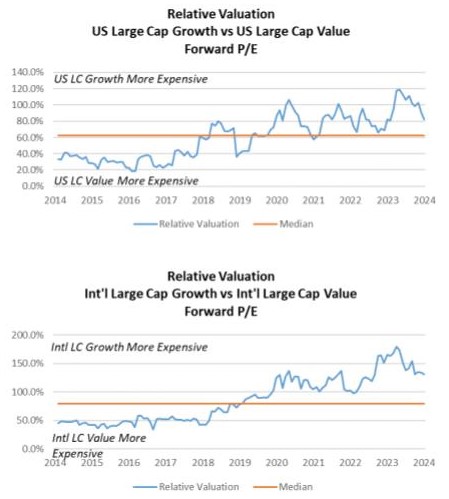

2024 Playbook: U.S. Equity

- Fundamental valuation metrics suggest that “growth” equities are still substantially more expensive than “value” equities.

- Economic considerations

- Economic considerations

- If there is a global economic recession in 2024, “value” stocks will likely outperform “growth” stocks.

2024 Playbook: Fixed Income

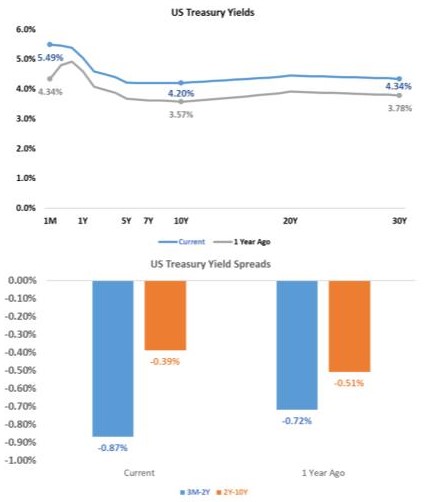

- Key sections of the U.S. Treasury yield curve have been inverted since the mid-summer of 2022.

- Yield curve inversion occurs when short-term rates are higher than long-term rates.

- Yield curve inversion has historically led to disruptions in borrowing and lending activity that may result in meaningful declines in economic activity.

- The longer a yield curve inversion persists (and the larger the size of the inversion), the more likely lending and borrowing activity will decline meaningfully.

- Economic considerations

- It is likely that the yield curve will flatten but remain inverted for much of 2024.

- The more rate cuts that occur in 2024, the more likely it is that the yield curve “dis-inverts.”

- In other words, if the yield curve “dis-inverts,” it will likely be a result of slower economic growth and lower inflation expectations.

A Note About Equity Market Selloffs

- Long-term investors should remember that equity market selloffs are often followed by periods of above normal returns.

- Investors that try to “time” market selloffs (i.e., sell stocks ahead of a market decline) usually fail to reinvest prior to the subsequent stock market recovery.

- Takeaways

- Long-term investors should never attempt to time the market.

- Riding out market volatility is the best way to build wealth over the long term.

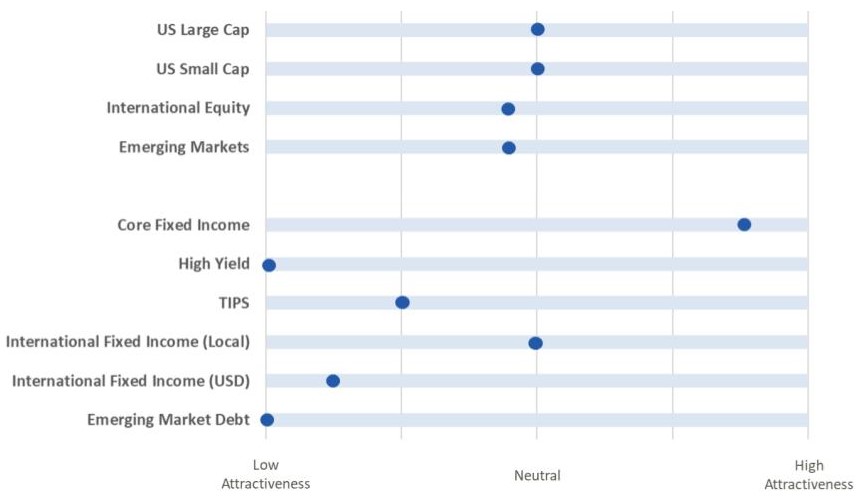

2024 Playbook Summary

- The above table indicates where each major investment asset class falls on the distribution of attractiveness (from low to high). This table is meant to provide a standardized and comparable view of the level of opportunity in each asset class category.

- In subsequent quarters, we will discuss any movement along the scale for each asset class and the driving forces behind the change in outlook.