Market Flash Report August 2024

Economic Highlights

United States

- Based on the final revision, the U.S. economy grew last quarter at a healthy 3% annual pace (revised up from +2.8%), fueled by strong consumer spending and business investment. This marked a sharp acceleration from a sluggish 1.4% growth rate in the first three months of 2024. Consumer spending, which accounts for about 70% of U.S. economic activity, rose at a 2.9% annual rate last quarter. That was up from 2.3% in the government’s initial estimate. Business investment expanded at a 7.5% rate, led by a 10.8% jump in investment in equipment.

- U.S. job growth during much of the past year was significantly weaker than initially estimated as the Bureau of Labor Statistics’ preliminary annual benchmark review of employment data suggests that there were 818,000 fewer jobs in March of this year than were initially reported. When spread through the prior year, the average monthly job gain from April 2023 through March 2024 was 173,500 versus nearly 242,000. The downward adjustments were limited to the private sector, with nearly half in the professional and business services industry (revised down by 358,000, or 1.6%.)

- The Federal Reserve’s (The Fed) preferred inflation gauge, the Personal Consumption Expenditures (PCE) Index, rose 0.2% M/M in July or 2.5% Y/Y. Core PCE, which excludes volatile food and energy, increased 0.2% M/M or 2.6% Y/Y. The important shelter component rose a stubborn 0.4% M/M in July and while goods inflation increased only 0.1%, services inflation jumped 3.7%. The Fed has clearly pivoted towards a more accommodative monetary policy stance with greater emphasis today on the deteriorating labor market situation versus the fight against elevated inflation. Markets are pricing in 4-5 rate cuts by the end of 2024, including the possibility of a 50 bps cut in September.

- Manufacturing in the U.S. remained weak and in contraction territory in August based on the latest Institute for Supply Management (ISM) reading. The headline ISM Manufacturing Purchasing Managers’ Index (PMI) rose from 46.8 in July to 47.2 in August. Employment and prices gained ground, but production and new orders weakened. Survey respondents cited slowing order books across various industries.

Non-U.S. Developed

- Business activity in the euro area’s private sector continued to expand modestly midway through the third quarter of the year. There were differing trends across the two broad sectors covered. Overall output growth was driven by a solid increase in business activity in the service sector, with the rate of expansion hitting a 4-month high. On the other hand, manufacturing production continued to fall markedly in August. The rate of contraction was broadly unchanged from that seen in July, and among the sharpest in 2024 so far. Activity in France improved while Germany remained subdued.

- Inflation in the eurozone fell to its lowest level since July 2021 at 2.2%. This August reading was down from the 2.6% annualized rate in the prior month. Energy prices fell 3%, but services inflation rose 4%. Core inflation was stable at 2.8%.

- The Japanese economy grew at a better-than-expected clip of 3.1% during Q2 after contracting 2.3% in Q1. Q2 growth was boosted by a rebound in consumer spending and business investment, but government spending was sluggish, and trade was a negative contributor. Inflation in Japan held steady at an annualized rate of 2.8% for the third straight month.

Emerging Markets

- Manufacturing in China remained in contraction territory in August, based on the latest official PMI reading. The headline reading of 49.1 in August marked the fourth consecutive month in contraction territory and a decline from 49.4 in July. The new orders and employment sub-components were weak in the August report. The smaller company focused Caixin Manufacturing PMI rose back above the important 50 level in August, driven by a stabilization in employment and increased demand.

- The official Non-Manufacturing PMI in China ticked up to 50.3 in August 2024 from July's 8-month low of 50.2. While new orders strengthened slightly, export orders and employment remained weak.

- Retail sales in China rebounded from a 17-month low in July, registering a gain of 2.7%. Although the pace of growth has slowed over the past year, retail sales have grown for 18 straight months.

- Brazil’s GDP expanded 3.3% Y/Y in the second quarter of 2024, accelerating from the 2.5% increase in the first quarter of 2024. The acceleration in the Brazilian economy could support the argument for rate hikes to slow the momentum. Growth was fueled by the services industry that benefited from elevated government spending.

- The Indian economy expanded by 6.7% from the previous year in the June quarter of 2024, slowing from the 7.8% increase in the earlier period and missing market expectations of a 6.9% growth rate. It was the slowest expansion in five quarters, owed to a sharp slowdown in government spending as the long-awaited general elections drove several usual government activities to halt.

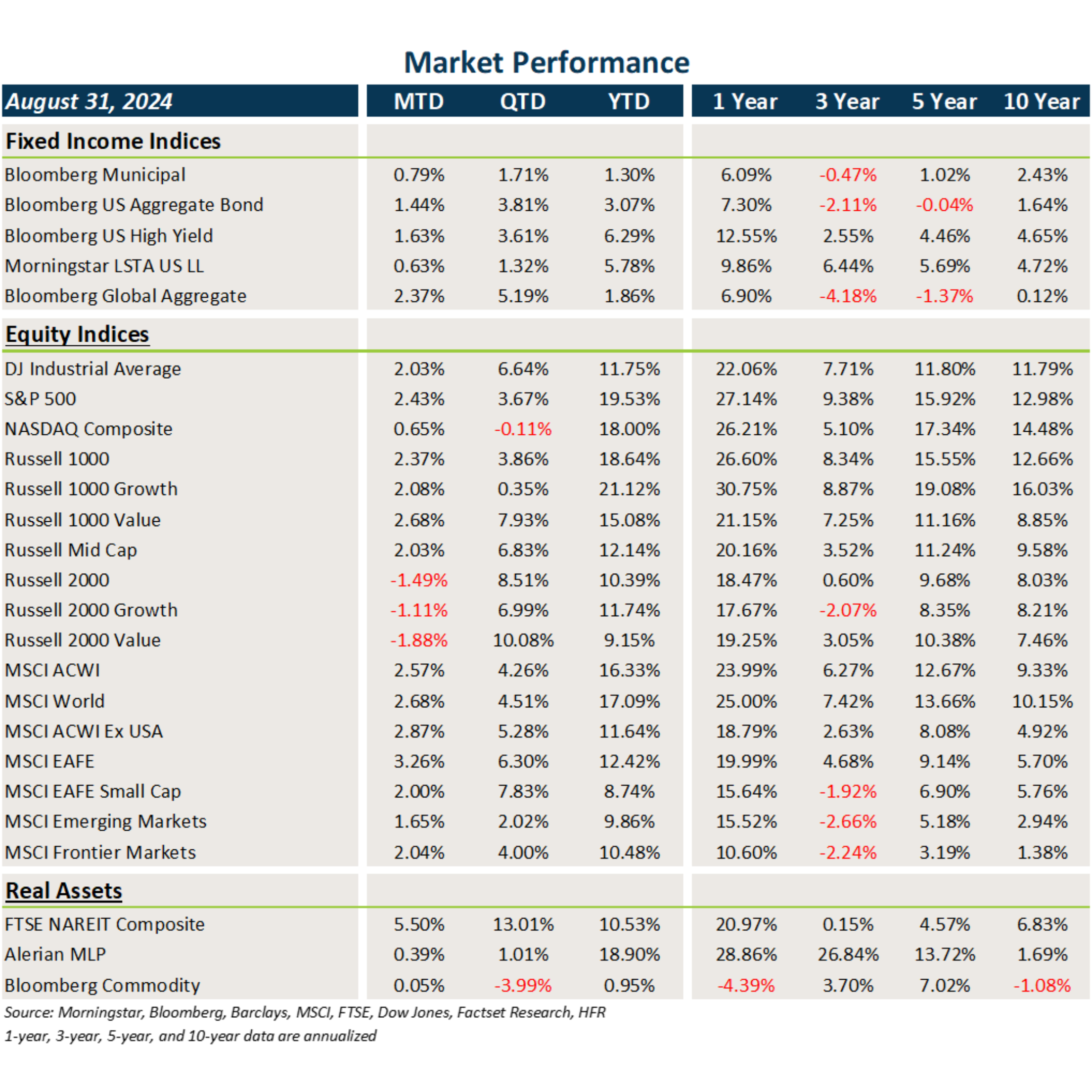

Fixed Income

- The decline in Treasury and other sovereign debt yields provided another strong month of performance for fixed income across the globe.

- Core fixed income and munis generated very solid performance while most areas of credit benefited from higher carry/starting yields.

- After being negative for most of the year, the Bloomberg Agg is now up over 3%.

- Bonds outside the U.S. also received a boost from the weaker U.S. dollar.

U.S. Equities

- U.S. equities were a mixed bag in August with gains in large caps and weakness across small caps.

- Value beat growth within large caps, but the opposite occurred within small caps.

- The S&P 500 has gained 19.5% in 2024 and the Russell 2000 is up 10.4%.

Non-U.S. Equities

- Equities outside the U.S. generally gained ground and outperformed U.S. equities last month. U.S. dollar weakness provided an added tailwind to non-U.S. assets.

- Unlike what occurred in the U.S., growth beat value across Europe, Australasia, and the Far East equities.

- The European Monetary System lagged developed markets in August, driven mainly be ongoing weakness and poor sentiment in Chinese equities.

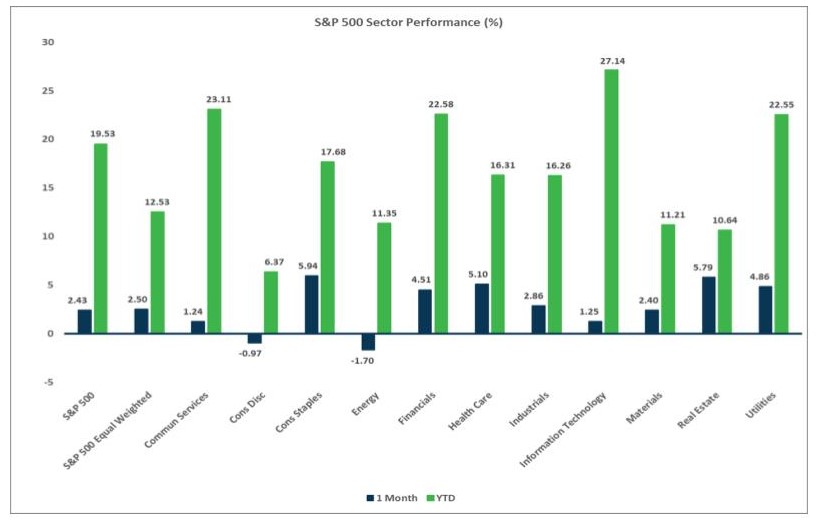

Sector Performance - S&P 500 (as of 08/31/24)

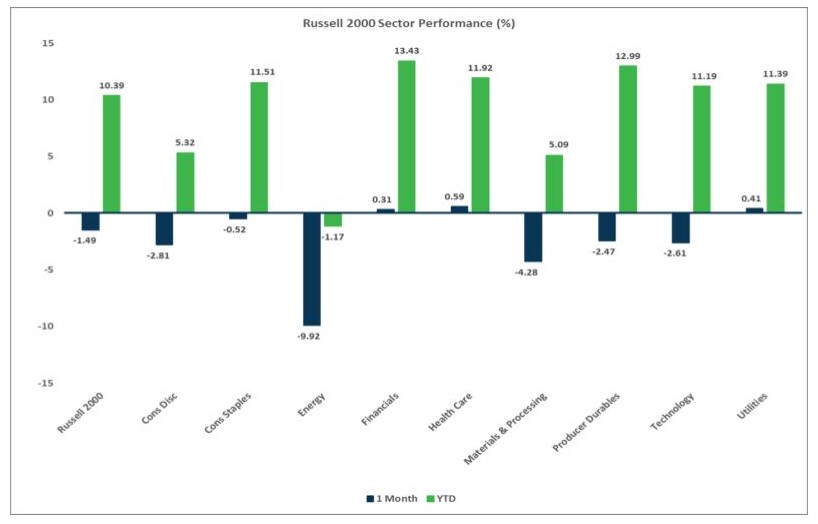

Sector Performance - Russell 2000 (as of 08/31/24)

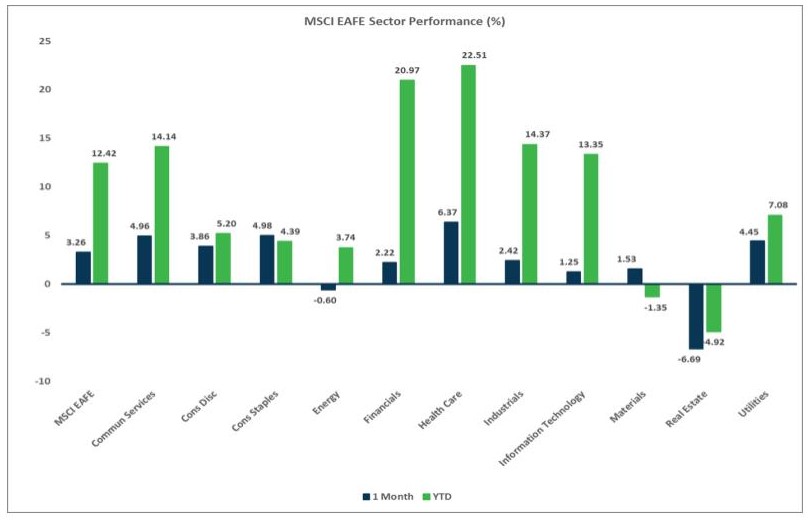

Sector Performance - MSCI EAFE (as of 08/31/24)

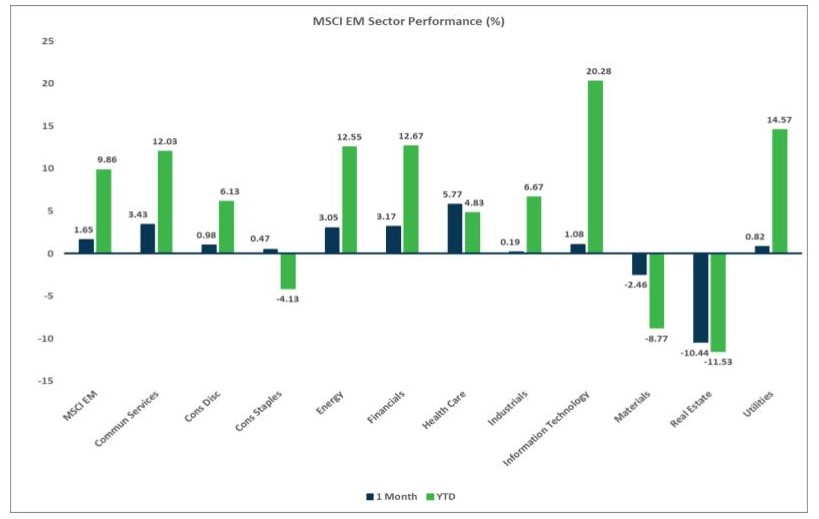

Sector Performance - MSCI EM (as of 08/31/24)